Why Creative Financing Commercial Real Estate Opens Doors Traditional Banks Won’t

Creative financing commercial real estate offers property owners and investors flexible alternatives when traditional bank loans fall short. Here are the main creative financing strategies available:

Most Common Creative Financing Methods:

- Seller Financing – Property owner acts as the lender

- Lease Options – Rent now, buy later with option to purchase

- Master Lease Agreements – Control property without immediate ownership

- Hard Money Loans – Fast, asset-based lending at higher rates

- Joint Ventures – Partner with other investors to share capital

- Wraparound Mortgages – New loan wraps around existing mortgage

- Private Money – Borrow from individuals instead of banks

Traditional bank loans require perfect credit, extensive documentation, and 25-30% down payments. Creative financing bypasses these problems by focusing on deal structure rather than borrower qualifications.

When Creative Financing Works Best:

- Distressed properties banks won’t touch

- Motivated sellers needing quick sales

- Properties with occupancy below 80%

- Buyers with limited cash reserves

- Rising interest rate environments

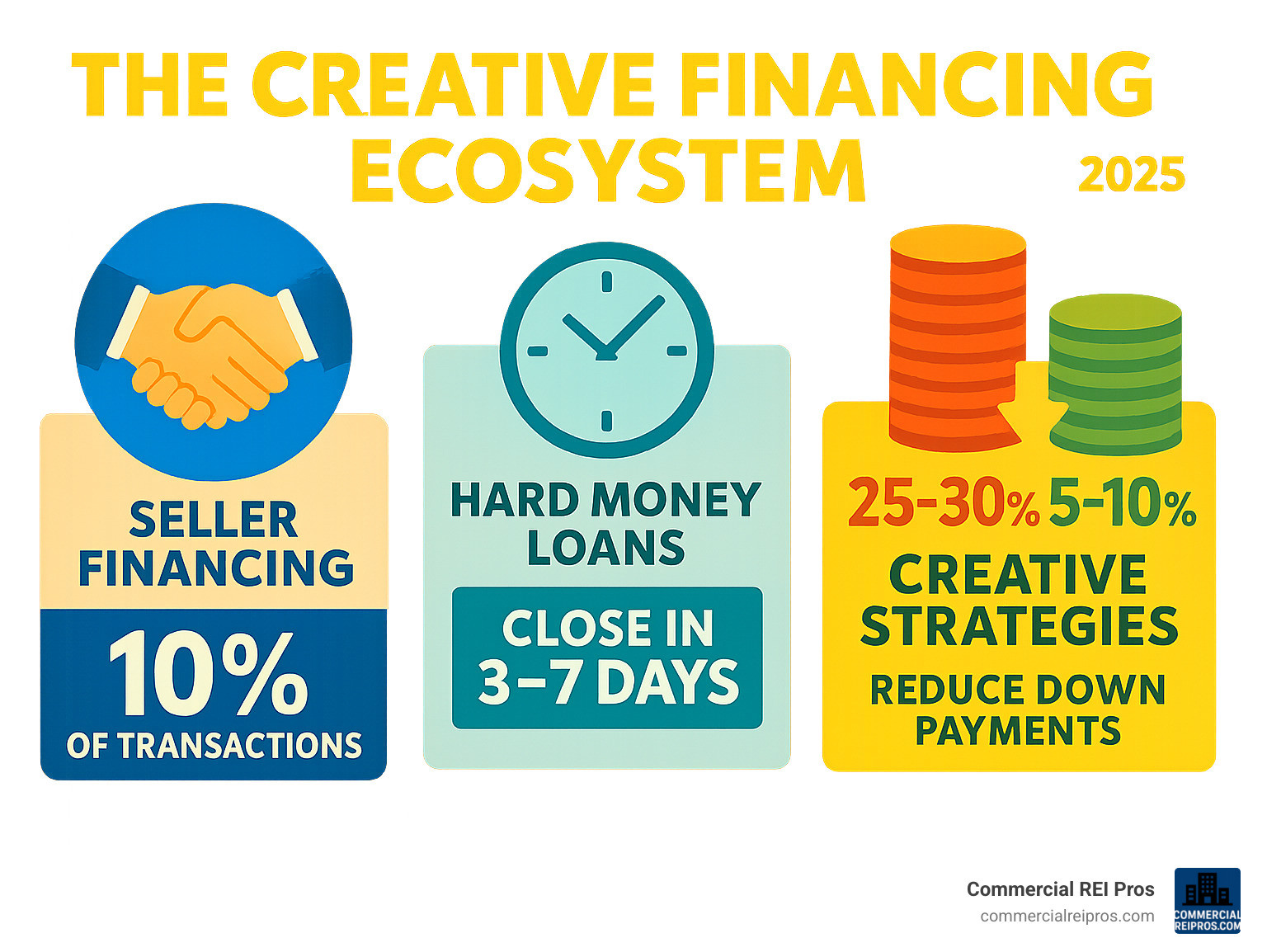

The research shows that seller financing accounts for approximately 10% of all real estate transactions, with higher rates in commercial deals. Hard money loans can close in 3-7 days versus 30-60 days for traditional financing.

Creative financing isn’t about avoiding banks – it’s about structuring deals that work for everyone involved.

I’m HJ Matthews, a commercial real estate investor with 10 years of experience using creative financing commercial real estate strategies to acquire undervalued properties across multiple asset classes. My background in digital marketing and business development has given me unique insights into structuring deals that traditional lenders often overlook.

Mastering Creative Financing Commercial Real Estate Fundamentals

Commercial real estate financing can feel overwhelming, but creative financing commercial real estate opens doors that traditional banks keep locked. Think of traditional lending like a big box store – everything is standardized and rigid. Creative financing is like a local market where everything is negotiable.

Banks demand 25-30% down payments and perfect credit scores (usually 680+). Creative financing often requires as little as 5-10% down, flexible credit requirements, and can close in days instead of months.

The magic happens with leverage – not just financial leverage, but leveraging relationships, timing, and market conditions. While banks focus on checking boxes, creative financing focuses on making deals work.

According to scientific research on creative financing, these alternative structures have been helping investors acquire properties for decades, especially when traditional financing falls short.

What Sets Creative Deals Apart From Bank Loans?

Speed changes everything in commercial real estate. While competitors wait 30-60 days for bank approval, you can close creative deals in 1-2 weeks. The real power comes from flexibility in deal structure – banks offer vanilla loans, creative financing lets you craft custom solutions.

Instead of fighting with underwriters, you’re working directly with sellers on mutually beneficial terms. Maybe you agree to higher purchase prices for below-market interest rates, or structure graduated payments that increase as you improve the property.

When Does Creative Financing Shine?

Creative financing commercial real estate becomes your secret weapon when traditional lenders run away. Properties with occupancy below 80% get rejected by banks but often represent the best opportunities.

Key scenarios include:

- Distressed properties needing quick action

- Low cash reserves situations

- Motivated sellers facing foreclosure or estate sales

- Rising interest rate environments where seller financing offers better terms

The current market has created more opportunities as property owners prefer installment sales to spread tax burdens, especially with highly appreciated assets.

The Creative Financing Toolbox: 10 Proven Structures

Creative financing commercial real estate offers multiple tools for different situations. Think of these as specialized instruments – each serves specific purposes and works best in particular scenarios.

Primary strategies include:

- Seller Financing – Property owner acts as lender

- Lease Options – Control now, buy later

- Master Lease Agreements – Management control without ownership

- Hard Money Loans – Fast, asset-based lending

- Joint Ventures – Partner with other investors

- Wraparound Mortgages – New loan encompasses existing debt

- Private Money – Individual investor funding

Seller Financing Deep-Dive — The Classic Win-Win

Seller financing creates genuine win-win scenarios impossible with traditional loans. The seller keeps legal title until payoff, while you get equitable title and control benefits.

Down payments typically range 10-20% versus banks’ 25-30%, sometimes as low as 5%. Interest rates run 1-3% above market but offer flexibility and speed that offset higher costs.

Sellers benefit through:

- Premium pricing (often 5-10% above market)

- Steady interest income

- Installment sale tax treatment

- Deferred capital gains taxes

Buyers gain:

- Flexible qualification criteria

- Faster closing (weeks vs. months)

- Access to properties banks won’t finance

According to research on seller financing, this strategy accounts for 10% of real estate transactions, with higher rates in commercial deals.

Hard Money & Private Money: Speed Over Cost

When speed matters more than cost, hard money and private money loans excel. Hard money focuses on property value rather than credit scores, with 8-15% interest rates and 6-24 month terms. Closings happen in 3-7 days versus 30-60 for traditional financing.

Private money offers more flexibility through individual investors rather than institutions. These relationships often provide better terms and lenders who understand local markets.

Ideal scenarios:

- Fix-and-flip projects needing quick acquisition

- Bridge financing during property improvements

- Auction purchases with tight deadlines

- Distressed properties requiring immediate attention

Partnerships & Joint Ventures

Joint ventures pool resources and expertise for larger deals. Typical structures involve general partners managing deals and limited partners providing capital, with 70/30 or 80/20 profit splits after preferred returns.

Crowdfunding has revolutionized commercial real estate since 2015, opening opportunities to 200,000+ new investors with minimums as low as $500. This creates new capital sources while giving smaller investors commercial property access.

Structuring Creative Deals Safely

Protecting yourself in creative financing commercial real estate is essential. Unlike bank loans where underwriters handle due diligence, creative deals put you in control.

Think of due diligence as insurance against surprises. Professional appraisals reveal true property values, while comprehensive inspections uncover hidden problems. Don’t skip environmental assessments – even basic Phase I studies prevent contamination liability.

Title searches reveal hidden liens or ownership disputes. Zoning compliance ensures your intended use is legal. For income properties, lease reviews verify rent rolls and identify tenant issues.

Proper documentation protects everyone. Promissory notes detail loan terms while deeds of trust secure property interests. Don’t use generic forms – each creative deal needs customized documentation.

Risk Mitigation & Legal Must-Dos

Every creative deal carries unique risks. The key is identifying risks upfront and building protections into deal structures.

Default remedies provide safety nets when deals go wrong. Personal guarantees from creditworthy parties give recourse options. Cross-default clauses link multiple properties so defaulting on one triggers default on all.

Insurance requirements go beyond basic coverage. General liability protects against claims, loss of rents maintains cash flow if properties become uninhabitable, and environmental liability covers older property risks.

For syndications with multiple investors, SEC compliance becomes critical. Regulation D exemptions are most common but require careful documentation and investor qualification.

Full disclosure builds trust and meets legal requirements. Being upfront about defects, projections, and risks protects relationships and prevents future problems.

Leveraging Assets & Government Incentives

Use existing assets to fund new deals. Home equity loans and HELOCs offer low rates for commercial down payments. Business equipment and receivables can serve as collateral.

SBA 504 loans provide government-backed financing with 10% down for owner-occupied properties (51%+ occupancy required).

Cross-collateralization creates 100% financing by using equity in one property to secure another. Government incentives like Opportunity Zones and historic preservation credits add value.

Scaling Your Portfolio With Creative Financing

Building wealth through creative financing commercial real estate requires systems for consistent acquisition. Each successful deal builds confidence and credibility for the next.

Portfolio lenders change the game by keeping loans in-house and making their own rules. Unlike traditional banks limiting you to four mortgages, portfolio lenders allow unlimited properties meeting their criteria.

Cross-collateralization creates powerful leverage. A $1 million building with $400,000 equity can potentially secure $1.6 million in additional acquisitions at 25% down.

The three-payday system maximizes profits per deal:

- First payday: Down payments from end users

- Second payday: Monthly spreads on rent-to-own arrangements

- Third payday: Principal paydown plus appreciation

Refinancing pathways provide clean exits. Creative financing often serves as bridge financing until you improve properties and qualify for traditional loans.

Case Studies: Real Success Stories

The Self-Storage Master Lease: An investor negotiated a master lease on a 60% occupied facility with a $250,000 option payment. Over three years, they increased occupancy to 95%, raising NOI from $73,603 to $285,542. The forced appreciation created $1.5 million in additional value – a 400% return on the initial investment.

The Office Building Wraparound: A 50,000 sq ft building carried a $2 million mortgage at 4%. The investor created a $3 million wraparound at 6%, giving the seller $1 million cash plus ongoing spread income while securing below-market financing.

Building Networks & Avoiding Mistakes

Success depends on relationships more than credit scores. Private lenders want safety, predictable returns, and clear communication – consistent base hits, not home runs.

Key team members include:

- Real estate attorneys specializing in creative structures

- Accountants familiar with creative deal tax implications

- Commercial brokers with off-market opportunities

Common mistakes to avoid:

- Insufficient due diligence

- Poor documentation

- Unrealistic income projections

- Inadequate reserves for surprises

- Weak exit strategies

Focus on solving problems and building relationships – the best opportunities come from repeat business and referrals.

Frequently Asked Questions About Creative Financing

Can I use creative financing if I have poor credit?

Creative financing commercial real estate works better for challenged credit than traditional loans. Banks obsess over credit scores while creative financing focuses on deal structure and mutual benefit.

Best options include:

- Seller financing where competence matters more than credit history

- Hard money loans based on property value, not borrower qualifications

- Joint ventures partnering strong credit with deal-finding skills

- Lease options requiring minimal upfront capital

Professional presentation with detailed projections and clear plans makes sellers focus on competence over past credit issues.

What down payment is typical in seller-financed deals?

Seller-financed deals typically require 10-20% down, with many closing at 5-10% when properly structured. Some deals close with zero down for distressed situations.

Factors affecting down payments:

- Property condition – distressed properties need less down

- Seller motivation – urgent situations create flexibility

- Negotiation approach – higher prices can reduce down payment requirements

- Market conditions – slower markets increase seller flexibility

How do I protect myself from due-on-sale acceleration?

Due-on-sale clauses let lenders demand full payoff when ownership transfers. Commercial lenders enforce these more aggressively than residential lenders.

Protection strategies:

- LLC structures may avoid triggering personal transfers

- Lease options delay ownership transfer while providing control

- Assumption negotiations with existing lenders

- Master leases structured as management contracts

Work with qualified legal counsel for proper documentation and disclosure.

Conclusion

Creative financing commercial real estate has the power to transform how you think about property deals. Throughout this guide, we’ve explored strategies that bypass traditional banking roadblocks and create opportunities where none seemed to exist.

The beauty of creative financing lies in its flexibility. When banks say no to your distressed property purchase, seller financing might say yes. When you lack the 30% down payment for conventional loans, a lease option could get you started with just 5% down. When time is critical, hard money loans can close in days instead of months.

We’ve seen these strategies work across Michigan markets, from small office buildings in Ann Arbor to large industrial complexes in Detroit. The key is understanding that creative financing commercial real estate isn’t about cutting corners – it’s about creating win-win solutions that traditional lending simply can’t accommodate.

The current market makes these strategies even more valuable. With over $1.4 trillion in commercial loan maturities approaching and banks tightening lending standards, property owners and investors need alternatives. Creative financing provides those alternatives.

At Commercial REI Pros, we’ve built our business around these principles. Based in Southfield, we serve property owners throughout Michigan who need fast, flexible solutions. Our direct-buy approach eliminates broker commissions and lengthy processes, while our creative financing expertise helps structure deals that work for everyone involved.

Here’s what makes our approach different:

We understand both sides of creative deals. When you’re selling a commercial property, we can structure purchases that provide immediate cash flow or deferred tax benefits through installment sales. When you’re buying, we can help identify properties where creative financing makes sense and connect you with the right resources.

Our Michigan focus means we know local markets intimately. We understand which areas have the best opportunities for forced appreciation, which properties banks avoid, and which sellers are most likely to consider creative terms. This local knowledge makes all the difference in structuring successful deals.

Ready to put creative financing to work?

Whether you own a commercial property that needs a quick sale or you’re looking to acquire your next investment, creative financing might be the solution you’ve been searching for. The strategies we’ve covered – from seller financing and wraparound mortgages to joint ventures and hard money loans – provide proven paths to successful deals.

Don’t let traditional lending limitations hold you back. The commercial real estate market rewards investors who understand creative financing, and with interest rates creating new challenges for conventional loans, these skills become even more valuable.

Contact Commercial REI Pros today to explore how creative financing commercial real estate strategies can work for your specific situation. Our team is ready to craft a bespoke funding plan that turns your real estate goals into reality – because in creative financing, there’s always a way to make the right deal work.

Remember: The best creative financing deals happen when everyone wins. With the right structure and professional guidance, your next commercial real estate success story is just one creative deal away.