Why Owners Are Googling “Commercial Property Cash Offer”

If you need to sell your property fast, a Commercial property cash offer gives you a quick, stress-free way to turn your real estate into cash—no agent fees, no repairs, and no waiting months for a buyer.

Here’s how “Commercial property cash offer” works:

- Submit your property details online or by phone.

- Receive a no-obligation cash offer in 24–72 hours.

- Schedule a quick site visit (if needed).

- Accept the offer—no commissions, no closing costs.

- Choose your closing date; get paid in as little as 7 days.

| Benefit | Traditional Sale | Cash Offer |

|---|---|---|

| Time to Close | Months | 7–30 days |

| Fees/Commissions | 4–6% of price | $0 (none) |

| Repairs Required | Usually Yes | Never (as-is) |

| Certainty | Falls through common | Sale is guaranteed |

You avoid the hassle of showings, negotiations, and financing delays. Cash buyers will purchase your property in any condition—even with code violations, tenant issues, or looming lease expirations.

“Cash offers that set you free. Selling for cash removes the stress and complications of traditional real estate sales.”

I’m HJ Matthews, a commercial real estate investor and digital marketer with over a decade of hands-on experience in Commercial property cash offer deals. I’ve helped owners across Michigan open up fast cash from their properties, no matter the situation or building type.

Understanding a Commercial Property Cash Offer

What Is a Commercial Property Cash Offer?

A Commercial property cash offer is a direct, all-cash bid from an investor or investment company to buy your property “as-is,” without the need for bank loans, mortgage approvals, or lengthy contingencies. Instead of waiting for a qualified buyer (who may need months for financing), you get a simple, immediate transaction—no repairs, no back-and-forth, and no risk of the deal falling apart because of lender red tape.

Key features include:

- As-Is Purchase: No repairs, cleaning, or staging needed. Cash buyers take properties in any condition—even those with code violations, deferred maintenance, or vacancies.

- Proof of Funds: Cash buyers provide verifiable funds, ensuring your sale won’t collapse due to financing issues.

- Accelerated Closing Timeline: Deals can close in as little as 7 days, with most offers delivered within 24–72 hours of your initial inquiry.

- Reduced Risk: No risk of buyer financing falling through—a common reason why traditional deals fail.

In Michigan, especially cities like Southfield, Ann Arbor, Novi, and Troy, property owners are increasingly choosing this route for speed and certainty.

Why Cash Beats Traditional Financing for Commercial Deals

Traditional commercial sales can be a marathon. Buyers must secure financing, often facing delays from appraisals, loan committees, and underwriting. According to industry research:

- Cash buyers can close in as little as 7 days, while traditional deals take 3–12 months.

- Most cash offer companies deliver a no-obligation offer within 24–72 hours.

- Financing failures are a leading cause of collapsed deals in commercial real estate.

Why does a cash offer win?

- No lender delays: No waiting for appraisals, loan approvals, or bank paperwork.

- No appraisal gaps: Price negotiations don’t get derailed by low appraisals.

- No “subject to financing”: The offer is as good as the cash in the buyer’s bank—guaranteed.

| Factor | Cash Offer | Conventional Sale |

|---|---|---|

| Time to Close | 7–30 days | 3–12 months |

| Fall-Through Risk | Negligible | High (financing, appraisal) |

| Repairs Needed | None (as-is) | Often required |

| Fees/Commissions | $0 | 4–6% + closing costs |

| Certainty | High | Moderate |

When Does Accepting a Cash Offer Make Sense?

Life has a way of throwing curveballs at property owners. Sometimes you need to move fast, and sometimes you need to move smart. A Commercial property cash offer can be your best friend in both situations.

Urgent Situations That Favor a Cash Exit

When crisis hits, time becomes your most valuable asset. Probate and estate sales are perfect examples—settling an estate is already stressful enough without waiting months for the right buyer. If you’re dealing with heirs scattered across different states or family members who need their inheritance quickly, a cash sale cuts through the red tape.

Foreclosure is another wake-up call. If you’re behind on mortgage payments or facing tax liens, every day counts. A traditional sale might take six months—time you simply don’t have. Cash buyers can close in as little as seven days, potentially saving thousands in equity that would otherwise disappear.

Lease expiration creates its own urgency. Picture this: your major tenant is moving out next month, and you’re staring down months of vacancy costs. Utilities, insurance, property taxes, and maintenance don’t pause just because your building is empty. A Commercial property cash offer lets you exit before those holding costs eat into your profits.

Then there are the properties that make other buyers run for the hills. Code violations, condemned status, or major structural issues don’t scare off cash buyers. They buy properties as-is, meaning you won’t spend months and thousands of dollars trying to make your property “market ready.”

Business troubles like bankruptcy or partnership disputes demand quick solutions. When partners can’t agree on the future of a property, or when your business needs immediate liquidity, a cash sale provides the clean break you need.

Long-Term Strategic Reasons

Not every cash sale is about crisis management. Smart investors use portfolio rebalancing to optimize their holdings. Maybe you want to consolidate your investments or shift from retail to industrial properties. Selling one asset quickly gives you the flexibility to move on better opportunities.

Market shifts can also trigger strategic sales. When interest rates climb or rental markets soften, experienced owners know when to take their chips off the table. A cash sale locks in today’s value instead of gambling on tomorrow’s uncertainty.

Opportunity cost is the silent killer of wealth building. Every month you spend trying to sell a slow-moving property traditionally is a month you’re not investing in something better. If you’ve found a great deal that requires quick action, a Commercial property cash offer on your current property can free up the capital you need to strike while the iron is hot.

Step-by-Step Guide to Getting a Commercial Property Cash Offer

Ready to see how a Commercial property cash offer actually works in real life? At Commercial REI Pros, we’ve made the process simple, fast, and as low-stress as possible—so you can skip the endless waiting and headaches.

Preparing Your Property Packet

First things first: a little organization on your end helps everything move faster (and can even boost your offer). Don’t worry—no fancy folders or expensive reports required. To get started, you’ll want to gather a few key items:

Rent rolls are helpful, showing who your tenants are, what their lease terms look like, and exactly how much is rolling in each month. Next, your Profit & Loss (P&L) statements—ideally for the last year or two—let us see your property’s true earning power and expenses. Toss in some recent photos of both the inside and outside, and don’t be shy about any rough spots; honesty saves time and keeps surprises out of the deal.

If you have them, environmental reports (like a Phase I or II) are especially helpful for industrial or land deals. And having your title documents handy—such as the deed, your mortgage statement, or info on any liens—means we can skip a lot of back-and-forth.

Pro tip: Total transparency about repairs, vacancies, or anything unusual on your property always works in your favor. The more we know, the easier it is to make our best possible Commercial property cash offer—no curveballs, just clarity.

The 6-Step Cash Offer Timeline

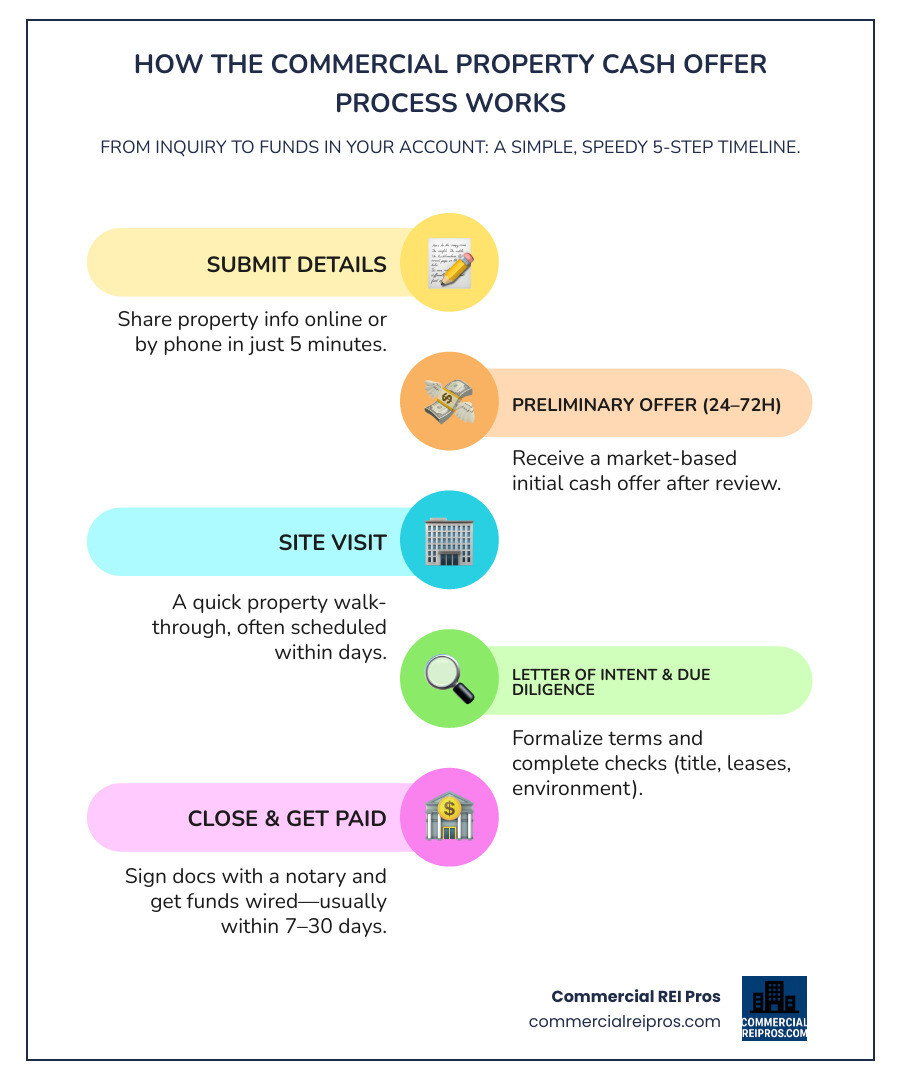

Here’s what you can expect, step by step:

- Submit Your Details: Spend five minutes filling out our simple form or giving us a quick call.

- Receive a Preliminary Offer (24–72 Hours): We review your property, run the numbers, and send you a no-obligation cash offer—fast.

- Site Visit: We arrange a quick walk-through at your convenience. Sometimes, we can even do it virtually.

- Formal Letter of Intent (LOI): This spells out the price, key terms, and expected closing timeline—so you know exactly what’s on the table.

- Due Diligence (3–10 days): We handle the nitty-gritty—title search, reviewing leases, checking environmental reports—lightning fast.

- Close & Get Paid (7–30 days total): You sign the closing docs (we can even send a mobile notary!), and the money gets wired directly to you.

Most sellers in Michigan close with Commercial REI Pros in as little as 10–30 days. For truly urgent situations, we’ve wrapped up deals in just 7 days—no middlemen, no endless paperwork.

If you have questions about this process, or want tips for preparing your packet, just contact us. We’re here to help you turn your commercial property into cash—quickly, easily, and with complete peace of mind.

Evaluating & Negotiating the Offer

Accepting a Commercial property cash offer is about more than just speed—it’s about making sure you walk away with a deal that truly works for you. Let’s break down what matters most when you’re sizing up that offer and getting ready to negotiate.

Understanding Value: Market Price, NOI, and Repairs

First things first: Is the offer fair? We start by looking at fair market value—that means taking into account recent comparable sales in your area, your building’s income, and its current condition. For commercial properties, much of the value comes down to the Net Operating Income (NOI). Cash buyers will review your rent rolls, expenses, and any vacancies to understand how much your property really makes.

Don’t stress about repairs or deferred maintenance. Needed fixes are factored into the offer, but you won’t be expected to pay anything out of pocket. The beauty of a Commercial property cash offer is that everything is “as-is”—no need to spruce up that peeling paint or deal with leaky pipes.

Sometimes, deals can be a little creative. For example, we can structure an offer to pay off back taxes, take over an existing mortgage, or close the sale even if you still have tenants in place. The goal is to make the transition smooth for everyone.

Reading the Fine Print

When reviewing your offer, pay special attention to the details. A serious cash buyer will include earnest money—a deposit that proves they’re not just kicking the tires. With Commercial REI Pros, you’ll never pay hidden fees or closing costs. We cover all title, legal, and transfer costs, keeping things truly hassle-free.

After closing, you want a clean break. That’s why our contracts are built to shield you from post-closing liabilities. Always review terms like indemnifications, warranties, and any lingering obligations—if you’re unsure, just ask us to explain in plain English.

Pro Tip: Always ask for proof of funds and request a clear, straightforward contract. We’re happy to show you both, so you can move forward with confidence.

Tips to Boost Your Net Proceeds

Getting the most from your Commercial property cash offer is all about smart strategy. You don’t have to spend a dime fixing things up—selling “as-is” is not just acceptable, it’s expected. If you have some wiggle room with your closing date, let us know; flexibility can sometimes nudge the price higher in your favor.

If you’re not in a rush, consider getting a few cash offers. Just remember, too many choices can lead to “analysis paralysis”—so weigh your options, but don’t let decision-making stall your progress.

When it’s time to negotiate, lean on proven strategies like anchoring your expectations and timing your acceptance. A little negotiation savvy can go a long way. Research shows that preparation and understanding market dynamics can significantly improve your negotiating position.

In the end, a cash sale should leave you with peace of mind, no loose ends, and a solid payout—without the headaches of a traditional sale. If you have questions as you review your offer, just reach out. We’re here to help every step of the way.

Legal, Tax & Due Diligence Checklist

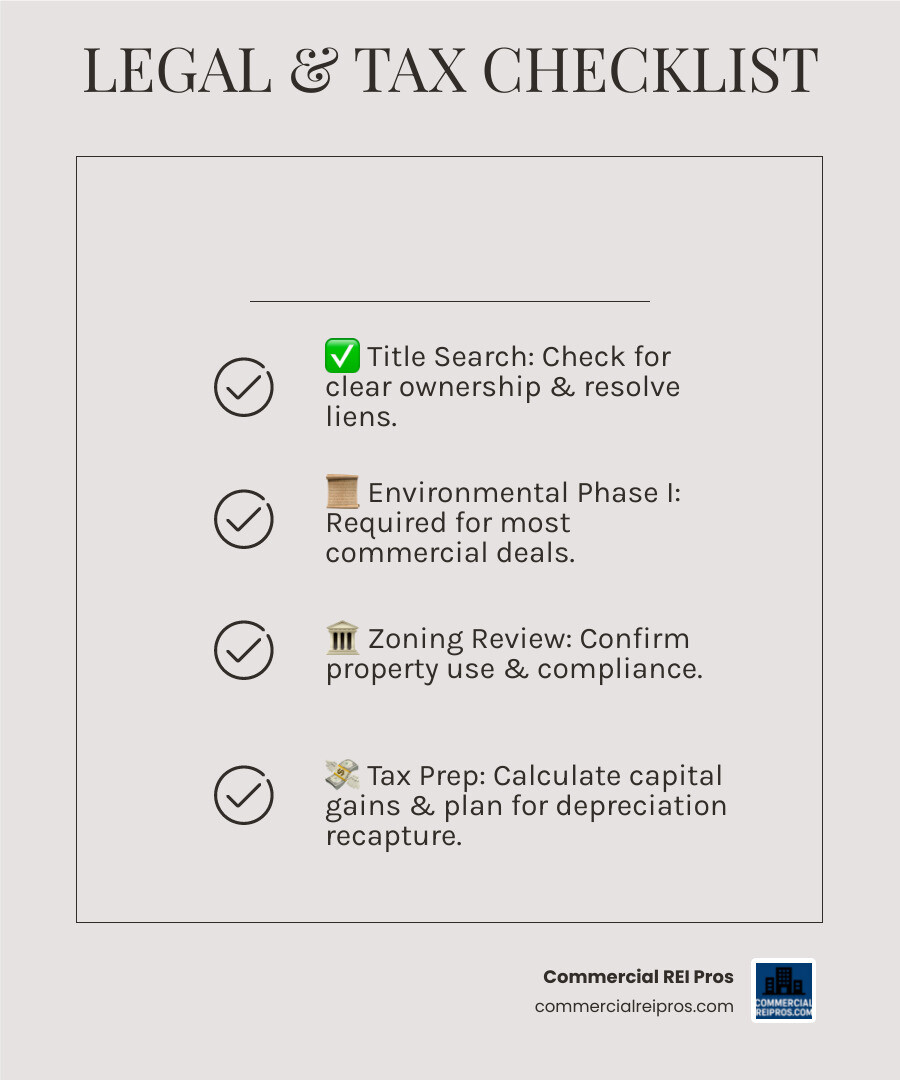

Even though a Commercial property cash offer moves fast, we never skip the important legal steps. Think of it as getting all your ducks in a row—quickly and professionally.

The good news? Most of this happens behind the scenes while you go about your day. We handle the heavy lifting, but it’s smart to know what’s happening.

Avoiding Legal Pitfalls in a Cash Sale

Let’s start with the basics that keep everyone protected. A title search is the first thing we do—it’s like a background check for your property. This ensures you actually own what you’re selling and reveals any surprise liens or encumbrances hiding in the paperwork.

Outstanding liens or back taxes aren’t deal-breakers. We can pay these off directly at closing from your sale proceeds. No need to scramble for cash upfront or delay the sale.

For many commercial properties, especially industrial sites or vacant land, we’ll need an environmental Phase I assessment. This checks for any contamination issues. Don’t worry—we order this and cover the cost as part of our due diligence.

We also do a quick zoning review to confirm your property’s legal use matches what’s on the books. Sometimes there are surprises, but we work through them.

Disclosure is your friend here. Be upfront about any known issues—roof leaks, code violations, foundation problems, whatever. Transparency actually helps you get a better offer because we can price things accurately from the start.

Most cash contracts are sold “as-is, where-is” with minimal warranties after closing. That’s actually great news for you—it means fewer legal headaches down the road.

Escrow setup keeps everyone safe. All funds go through a licensed title company or attorney escrow, never directly between parties. Your money is protected every step of the way.

Tax Implications & 1031 Alternatives

Here’s where things get interesting from a tax perspective. Selling commercial property can trigger capital gains tax on your profit, so definitely loop in your CPA early in the process.

Depreciation recapture is another consideration. If you’ve owned the property for a while, you’ve likely claimed depreciation deductions over the years. Uncle Sam wants some of that back when you sell—it’s called recapture tax.

But here’s the thing—sometimes the speed and certainty of a cash sale outweighs the tax implications. No more mortgage payments, property taxes, insurance, or maintenance costs. That monthly cash flow improvement can be substantial.

If you’re looking to reinvest in another property, a 1031 exchange lets you defer capital gains taxes by rolling your proceeds into a similar investment. This strategy allows qualified investors to defer taxes by exchanging one investment property for another of like-kind value.

Installment sale options are rare with cash buyers, but occasionally we can structure deals to spread out your tax liability over multiple years. This depends on your specific situation and our current investment strategy.

The bottom line? A fast cash sale gives you options and liquidity. Work with your tax advisor to understand the implications, but don’t let tax concerns paralyze you from making a smart business decision.

Frequently Asked Questions About Commercial Property Cash Offers

How fast can a commercial property cash offer close?

- As fast as 7 days if you have clear title and documentation.

- Typical timeline: 7–30 days.

- Proof of funds and mobile notaries mean you can close from anywhere.

Will I net less money by accepting a cash offer?

- No commissions or fees: Traditional sales cost 4–6% in agent commissions, plus closing costs.

- No repair costs: Sell as-is, saving tens of thousands in repairs.

- Certainty Premium: The price may be slightly below “retail,” but you avoid months of holding costs, taxes, and risk of a failed deal.

Can I sell a tenant-occupied property for cash?

- Yes. We analyze the leases, verify rent rolls, and can take over as landlord at closing.

- No need to evict tenants: We’ll honor existing leases, and handle all paperwork.

- Estoppel Certificates: Tenants may be asked to sign these, confirming lease terms for the buyer.

Conclusion

If you’re looking for the fastest, simplest, and most reliable way to sell your commercial property, a Commercial property cash offer is hard to beat. At Commercial REI Pros, we buy properties directly from Michigan owners—no middlemen, no broker fees, and absolutely no need to fix up or clean out your building. That means you get speed, certainty, and a totally hassle-free experience.

Maybe you’re ready to move on from a tricky property, facing foreclosure, or just want to open up your equity and put your money to work somewhere new. Whatever your situation, our team makes it easy to close on your timeline—often in as little as seven days. You’ll know exactly what you’re getting, with no surprises or delays.

Plus, because we’re local investors, you get the personal touch. We understand Michigan markets and work hard to offer creative solutions—even for tough situations like code violations, tax liens, or tenant troubles.

Want to find out how much you could get for your property? Contact Commercial REI Pros today to learn about our hassle-free selling process and see just how easy a Commercial property cash offer can be.

Ready to see just how smooth selling can be? Send us your property details today, and take the first step toward a worry-free closing with Commercial REI Pros.