Why Cash for Commercial Property is the Fast Track to Freedom

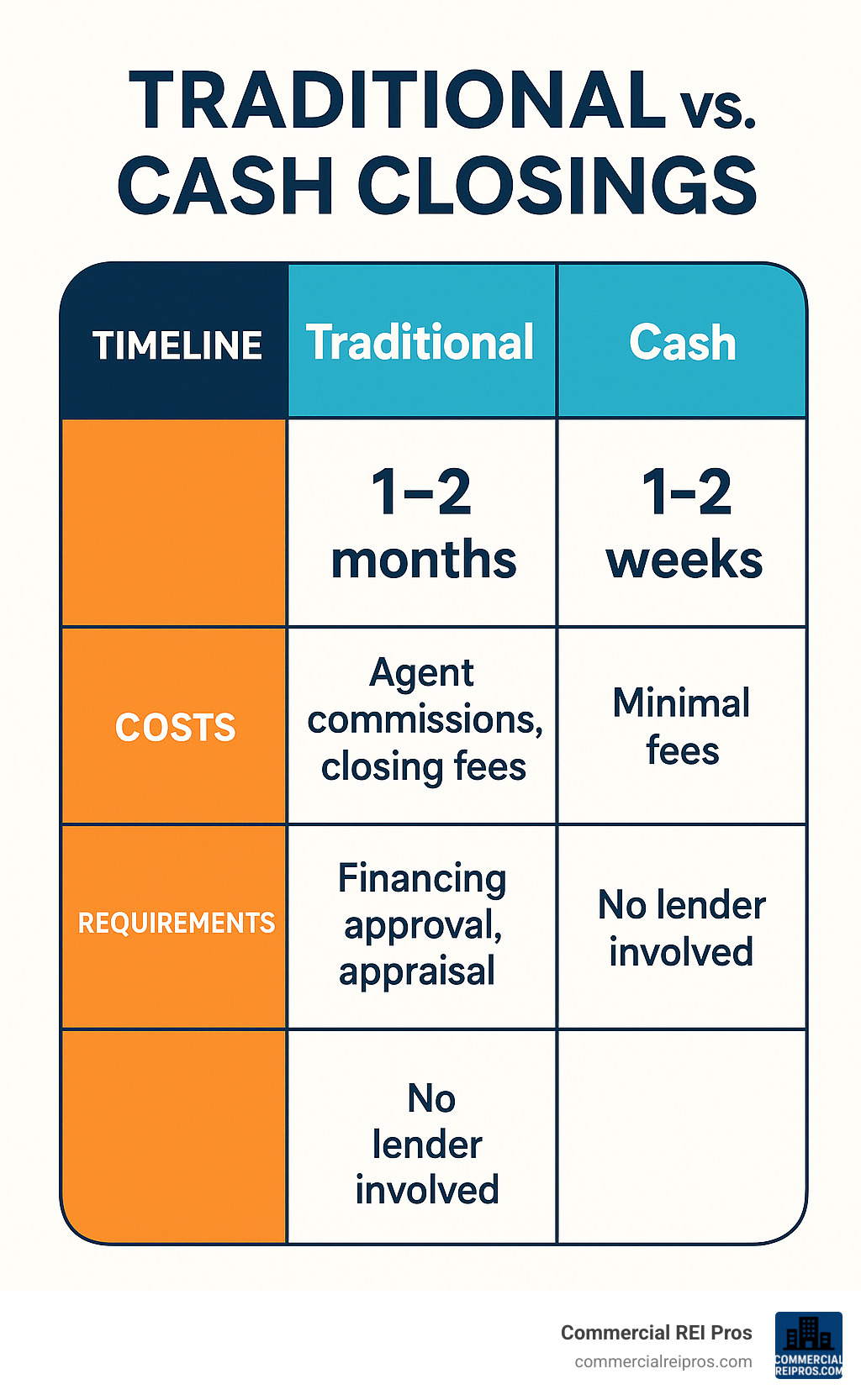

Cash for commercial property offers the fastest path to liquidity when you need to sell quickly – often closing in as little as 7 days compared to traditional sales that can drag on for months or even years.

Quick Answer: Cash for Commercial Property Benefits

- Speed: Close in 7-14 days vs. 3-6 months traditionally

- Certainty: No financing contingencies or buyer qualification risks

- Cost Savings: Avoid broker commissions (typically 6% of sale price)

- Convenience: Sell as-is without repairs or improvements

- Flexibility: Choose your closing date and terms

The commercial real estate market has seen a significant shift toward cash transactions, with up to 30% of CRE purchases being cash deals according to NAR research. This trend reflects investors’ desire for speed and certainty in an increasingly complex market.

Traditional commercial property sales involve lengthy due diligence periods, financing approvals, and extensive marketing campaigns that can stretch for months. Cash buyers eliminate these problems by bringing immediate liquidity and the ability to close without contingencies.

Whether you’re facing foreclosure, dealing with difficult tenants, or simply want to free up capital quickly, cash sales offer a streamlined alternative to the traditional brokerage process.

I’m HJ Matthews, a commercial real estate investor with over 10 years of experience in cash for commercial property transactions throughout Michigan. Through my work at Commercial REI Pros, I’ve helped dozens of property owners steer quick cash sales.

Why Consider Cash for Commercial Property?

When you’re ready to sell your commercial property, cash for commercial property buyers offer something that traditional financed buyers simply can’t match: complete certainty. No more sleepless nights wondering if the buyer’s loan will get approved or if the deal will fall through at the last minute.

Cash transactions now make up a significant portion of commercial real estate deals. According to NAR research, these direct cash purchases eliminate the financing risks that derail so many traditional sales.

When a cash buyer makes an offer, they’re not waiting for bank approvals, appraisals that might come in low, or underwriting departments that change their minds. They’ve already got the money ready to wire at closing.

Closing in a week isn’t just a marketing promise – it’s what actually happens when financing isn’t part of the equation. The fee savings alone can be eye-opening. Traditional commercial brokerage typically costs around 6% of your sale price. On a $500,000 property, that’s $30,000 you get to keep instead of paying in commissions.

Key Benefits at a Glance

Speed changes everything about how you can plan your next moves. Instead of the typical 3-6 month traditional sale timeline, you’re looking at 7-14 days from offer to closing. That means no more months of paying property taxes, insurance, and maintenance on a property you’re trying to sell.

Reduced opportunity cost is huge when you’re an active investor or business owner. Every month your property sits on the market is another month you can’t use that capital for other investments or business needs.

Improved cash flow planning becomes so much easier when you know exactly when you’ll receive your funds.

Potential Drawbacks to Weigh

The price trade-off is the most obvious consideration. Cash buyers typically offer 10-20% below full market value to account for the speed and convenience they’re providing. However, when you factor in the commissions you’re avoiding, the holding costs you’re eliminating, and the repairs you don’t have to make, that gap often shrinks considerably.

Limited bidders means you won’t have multiple offers driving up your price in a bidding war. Negotiation pressure can feel intense since many cash buyers present straightforward offers with relatively short response windows.

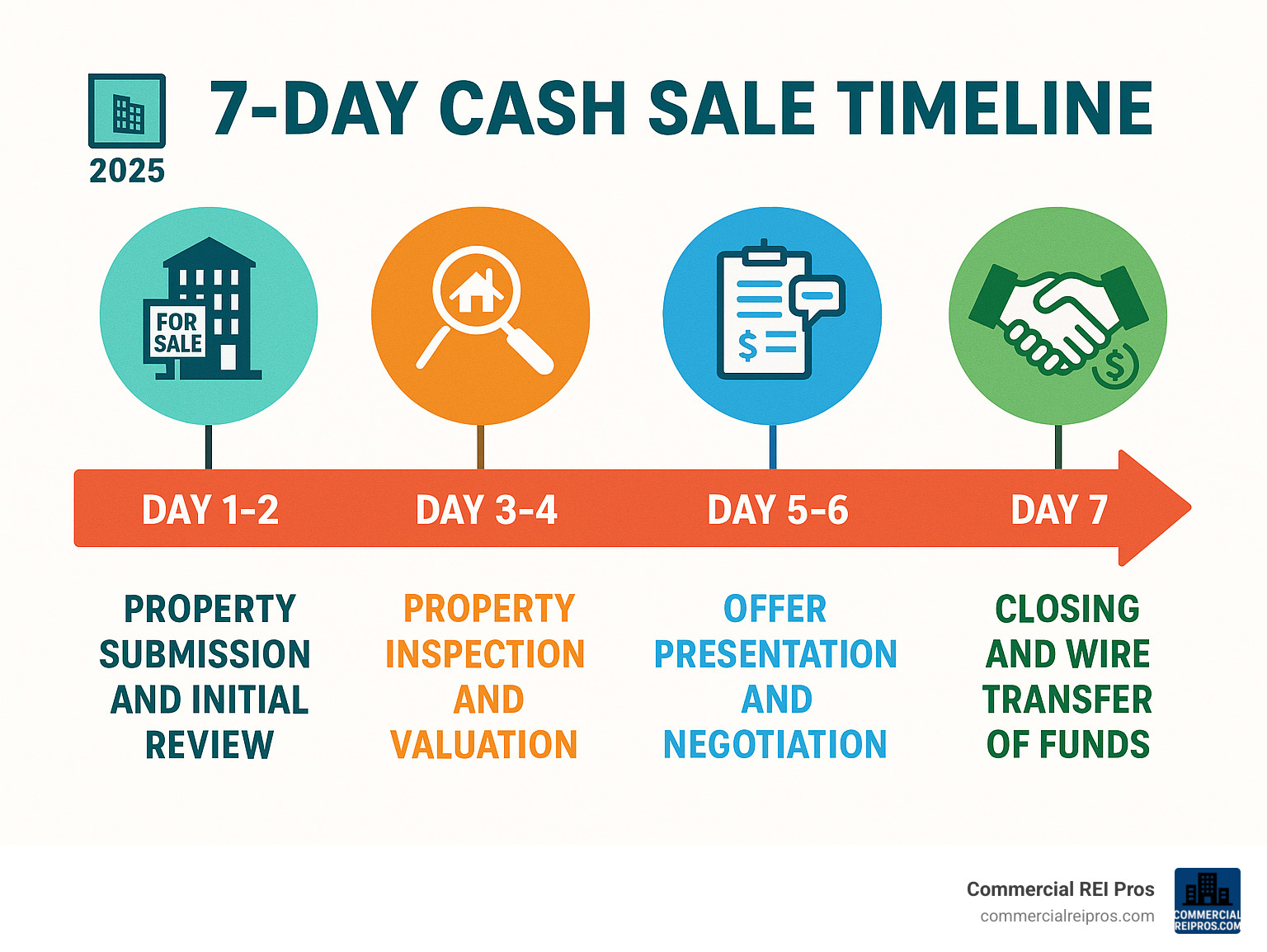

Step-by-Step Guide: From Offer to Closing

Selling your commercial property for cash doesn’t have to be complicated. After helping dozens of Michigan property owners through this process, I’ve learned that the best cash for commercial property transactions happen when everyone knows exactly what to expect.

The beauty of a cash sale is its simplicity. While traditional commercial sales involve mountains of paperwork, financing contingencies, and endless delays, cash transactions cut straight to the essentials.

Day 1-2: Property Submission and Initial Review

Everything starts with a simple conversation. You can fill out our online submission form or just give us a call with the basics. Within 24 hours, we’ll have done our homework on your property and scheduled a time to see it in person.

Day 3-4: Property Inspection and Valuation

We’ll walk through every corner, checking everything from the HVAC system to the tenant mix. We’re not looking for perfection – we buy properties as-is – but we need to understand what we’re purchasing. During this visit, we’ll also verify your income statements and get a feel for the local market.

Day 5-6: Letter of Intent and Negotiation

Once we’ve crunched the numbers, we’ll present our cash offer through a Letter of Intent (LOI). This document spells out our proposed purchase price, closing timeline, and any specific terms. We’re always open to discussion.

Day 7: Closing and Funding

With clear title confirmed by the title company, we meet at closing to sign the paperwork. You’ll receive your funds via wire transfer within 48 hours of signing. No waiting for checks to clear, no last-minute financing hiccups.

Getting Started With a Cash Sale

Seller preparation is refreshingly simple compared to traditional sales. You won’t need glossy marketing brochures or professional staging. What we do need are the real numbers – your recent rent roll, basic operating expenses, and any lease agreements you have on file.

Your rent roll tells the story of your property’s income potential. We need to know which tenants pay on time, who’s behind on rent, and whether anyone is planning to move out.

Timeline Breakdown

Our offer comes fast – typically within 24 to 72 hours after we’ve seen your property and reviewed your documentation. Inspection happens the same week we first contact you. Closing within 7 to 14 days is realistic for most properties with clear title. Wire funds arrive within 48 hours of closing.

Cash for Commercial Property Process in Michigan

We’ve fine-tuned our process specifically for Michigan’s commercial real estate market. Whether you’re looking to Sell Michigan Office Building or Sell Michigan Retail Building, we understand the local market dynamics that affect your property’s value.

Our coverage spans all major Michigan markets. Check our Cities We Buy In page to see if your property falls within our service area.

Maximizing Your Cash Offer: Valuation, Negotiation & Proof of Funds

Getting the best cash for commercial property offer isn’t just about luck – it’s about understanding how cash buyers think and positioning your property accordingly. After years of evaluating properties across Michigan, I can tell you that sellers who understand the valuation process consistently get better offers.

Net Operating Income (NOI) forms the backbone of every commercial property valuation. We take your total rental income, subtract all operating expenses (taxes, insurance, maintenance, management), and what’s left is your NOI. This number tells us exactly how much cash the property generates each year.

Cap rates vary dramatically based on property type and location. A pristine office building in downtown Birmingham might trade at a 6% cap rate, while a tired strip mall in a secondary market could be 10% or higher. We’re constantly monitoring LoopNet market data to stay current on these rates.

Market comparables provide useful context, but they’re not the whole story for cash buyers. We care more about what your property will produce in income tomorrow than what a similar building sold for six months ago.

The as-is discount reflects reality – cash buyers purchase properties exactly as they sit today. If your roof needs $30,000 in repairs, we’ll factor that into our offer rather than asking you to fix it first.

How Buyers Price Cash for Commercial Property

The income approach dominates how we value commercial properties. It’s straightforward math: take your NOI and divide by our required cap rate. A property generating $80,000 in NOI at an 8% cap rate equals $1 million in value.

Location premium can swing values significantly. Properties in Troy or Ann Arbor command higher prices than identical buildings in less desirable areas. Risk adjustments account for the human element. A building with three credit tenants on 10-year leases gets priced differently than one with month-to-month tenants.

Negotiation Hacks to Raise Your Net

Multiple offers create healthy competition even among cash buyers. Highlight growth upside by documenting opportunities the numbers don’t fully capture. If your retail tenants are paying $15 per square foot but market rates are $18, that’s immediate upside we can factor into our valuation.

Flexible closing dates can be worth real money. We’ve paid premiums for sellers who could accommodate tight timelines or specific closing dates.

Verifying Buyer Credibility

Not all cash buyers are created equal. Bank statements should show liquid funds equal to your property value plus closing costs. Attorney escrow protects everyone involved. Insist on closing through a reputable title company or attorney’s office.

Track record matters more than slick marketing materials. Ask for references from recent transactions and verify they actually closed deals similar to yours.

At Commercial REI Pros, we provide bank statements, attorney references, and a list of recent closings upfront.

Special Scenarios Where Cash Shines

Sometimes commercial properties come with baggage that makes traditional buyers run for the hills. That’s exactly when cash for commercial property becomes your best friend. These challenging situations often create the most compelling reasons to pick up the phone and call a cash buyer.

Liens and back taxes don’t have to derail your sale. We regularly purchase properties with outstanding tax liens, contractor liens, or other title problems. The beauty of working with cash buyers is that we handle all the messy resolution work as part of the closing process.

Foreclosure situations require the kind of speed that only cash can deliver. When you’re facing foreclosure, you might have just weeks to complete a sale before losing everything. Traditional buyers with financing simply can’t move that quickly. Cash buyers can often close before the foreclosure date, saving your credit and recovering some equity.

Code violations don’t necessarily spell doom for your sale. We’ve purchased properties with health department violations, fire code issues, and other regulatory headaches. The key is pricing these problems appropriately rather than expecting you to resolve them first.

Even condemned buildings can find the right buyer. The structure might need to be demolished, but the land underneath could have serious development potential.

Vacant assets actually make our job easier in many ways. Empty buildings can close faster since there’s no need to coordinate with tenants, transfer security deposits, or deal with lease assignments.

Difficult tenants can actually make properties more attractive to certain cash buyers. If you’re dealing with problem tenants, non-paying renters, or ongoing eviction proceedings, experienced investors often see opportunity where others see problems.

Portfolio bulk sales work particularly well with cash buyers. If you’re looking to sell multiple properties at once, cash buyers can often structure deals that traditional buyers can’t match.

Turning Headaches into Offers

Lien resolution is often much simpler than property owners expect. We work with experienced title companies to identify all liens and factor their payoff into our offer. You don’t need to spend months resolving these issues before selling.

Tax negotiation can sometimes reduce the amount owed significantly. We have experience working with local tax authorities to negotiate payment plans or reductions.

Cash for Commercial Property When You Have Outstanding Debt

Foreclosure avoidance requires immediate action, but it’s often still possible even when things look dire. If you’re behind on mortgage payments, a cash sale might be your only option to avoid foreclosure and protect your credit.

Quick equity recovery helps you salvage value from what feels like a hopeless situation. Even if you owe more than the property seems worth in its current condition, a cash sale might recover some equity and avoid the total loss that comes with foreclosure.

The bottom line? What looks like a problem property to most people might be exactly what an experienced cash buyer is looking for.

Finding and Vetting Reputable Cash Buyers

When you’re ready to sell your commercial property for cash, finding the right buyer makes all the difference between a smooth transaction and a nightmare experience. Legitimate cash for commercial property buyers are out there – you just need to know where to look and how to separate the professionals from the pretenders.

Direct investors represent your best bet for a straightforward transaction. These are companies like Commercial REI Pros that purchase properties for their own investment portfolios. We’re not middlemen or wholesalers – we’re the actual end buyers with our own funds ready to close.

Online platforms can connect you with potential buyers, but exercise caution with lead generation services that blast your information to dozens of “investors.” Quality trumps quantity every time.

Networking within the commercial real estate community often yields the most reliable connections. Local CCIM chapters, real estate investment groups, and industry meetups are goldmines for meeting legitimate cash buyers.

Referrals from trusted advisors like your attorney, accountant, or other real estate professionals frequently lead to the most trustworthy buyers.

Title company closings should be non-negotiable in any discussion with potential buyers. Any legitimate cash buyer will readily agree to close through a reputable title company or attorney’s office.

Where to Source Buyers Fast

CREXi and similar platforms allow you to market directly to investors who are actively seeking cash for commercial property opportunities. These platforms have sophisticated filters that let you target buyers who specifically purchase with cash.

Showcasing your property to local investment groups through their regular meetings and online forums can generate serious interest.

Off-market research can help you identify recent cash buyers in your area. Public records reveal who’s been purchasing commercial properties with cash, and these active buyers are often interested in additional opportunities.

Due Diligence Checklist

Before getting too deep into negotiations, you need to verify that your potential buyer is legitimate and capable of closing. Entity searches should confirm the buyer’s business registration and good standing with the state.

BBB ratings and online reviews provide valuable insight into a buyer’s reputation and track record. Past closings can be verified through public records and direct references.

Red Flags to Avoid in Cash for Commercial Property Deals

Last-minute price reductions are the calling card of disreputable buyers. They present an attractive initial offer to get you committed, then mysteriously find “problems” during due diligence that justify slashing the price.

Proof of funds delays should trigger immediate concern. If someone claims to have cash available but can’t provide bank statements or other verification within 24-48 hours, they’re probably not legitimate.

High-pressure tactics like unreasonably short deadlines or demands for exclusive agreements before showing proof of funds are major warning signs.

When you’re ready to explore your options, Contact us for a straightforward conversation about your property and timeline.

Frequently Asked Questions about Cash for Commercial Property

What costs will I still pay at closing?

Even with cash for commercial property transactions, you’ll still have some closing costs – but they’re much smaller than traditional sales. You’ll typically pay prorated property taxes up to the closing date, any outstanding utility bills, and your portion of title insurance costs.

The good news? You’ll avoid the big expenses that eat into traditional sales. No realtor commissions (usually 6% of the sale price), no loan origination fees, and no repair costs since you’re selling as-is. Most cash buyers, including us at Commercial REI Pros, cover the majority of closing costs as part of our service.

When we recently helped a client sell their Detroit office building, their total closing costs were under $3,000 – compared to the $42,000 in commissions they would have paid through traditional brokerage.

Can I sell multiple properties in one cash transaction?

Absolutely! Many cash buyers actually prefer portfolio deals because they can achieve economies of scale. We regularly purchase multiple properties from the same seller in a single transaction, and it often works out better for everyone involved.

Portfolio sales can increase your net proceeds since the buyer can spread their due diligence costs across multiple assets. Instead of paying for separate appraisals, title searches, and inspections on each property, these costs get consolidated.

We recently closed on a four-property portfolio in Grand Rapids – two retail buildings and two small office complexes. The seller got a better price per property than if they’d sold individually, and the entire transaction closed in just 10 days.

Do I need to make repairs before selling as-is?

Definitely not – that’s the whole point of cash for commercial property sales! Cash buyers evaluate properties in their current condition and factor repair costs into their offers. Making repairs before selling usually doesn’t increase your net proceeds enough to justify the time, cost, and hassle involved.

We’ve bought properties with leaky roofs, outdated HVAC systems, and tired interiors. Our offers account for these issues upfront, so you don’t have to deal with contractors, permits, or construction delays.

One seller in Ann Arbor was worried about $15,000 in needed roof repairs. Instead of spending months getting quotes and managing contractors, they sold to us as-is. After factoring in the time value of money and avoided hassle, they actually came out ahead compared to making repairs first.

The beauty of as-is sales is that you transfer all the repair headaches to the buyer. No more worrying about whether improvements will actually increase your sale price or dealing with contractors who don’t show up on time.

Conclusion

When you need to turn your commercial property into cash quickly, cash for commercial property sales provide the most direct path forward. Yes, you might see a slightly lower gross price than what you’d hope for on the traditional market, but when you add up the speed, certainty, and money you save on fees, your net proceeds often end up being surprisingly competitive.

Closing in 7-14 days means you stop paying property taxes, insurance, and maintenance costs immediately. Avoiding broker commissions keeps thousands of dollars in your pocket. Selling as-is means you don’t spend time and money on repairs that may not even increase your sale price.

These advantages make cash sales especially valuable when life throws you curveballs. Maybe you’re staring down foreclosure, dealing with tenants who haven’t paid rent in months, or you’ve found an amazing investment opportunity that requires immediate capital. Traditional sales just can’t move fast enough for these situations.

The secret to success with cash for commercial property transactions is simple: work with buyers who actually do what they say they’ll do. Check their track record, verify they have the funds, and make sure they close through proper channels.

We’ve spent years building Commercial REI Pros on a foundation of straight talk and fast action throughout Michigan. As Southfield’s direct commercial property buyer, we cut out the middleman entirely. When we make an offer, you’re dealing directly with the people who will own your property.

Ready to see what your property could bring in a cash sale? Contact us today for a no-obligation conversation. We can often give you a ballpark figure over the phone and have someone out to see your property within 24 hours.

The commercial real estate market will always have its ups and downs, but one thing stays constant: sometimes you need to move fast. Cash for commercial property sales give you that option when traditional methods just won’t work. More info about selling commercial property smoothly is waiting on our website, including all the details about how we work and where we buy throughout Michigan.