Why Selling Your Apartment Building with Tenants is Completely Legal and Often Beneficial

Can you sell apartment building with tenant? Yes, you absolutely can sell an apartment building with tenants still living in it. In fact, 90% to 95% of commercial real estate transactions involve tenants staying with the property after the sale.

Quick Answer for Property Owners:

- Legal: Selling with tenants is completely legal in all states

- Leases Transfer: Existing leases automatically transfer to the new owner

- Tenant Rights: Tenants can stay until their lease expires

- Buyer Appeal: Many investors prefer properties with tenants already in place

- Notice Required: You must provide proper notice for showings (typically 24 hours)

- Security Deposits: These transfer to the new owner at closing

The process might seem complex, but it’s actually quite straightforward. When you sell a tenant-occupied building, the new owner simply steps into your shoes as the landlord. They inherit all existing lease agreements, rental income, and tenant relationships.

This can actually be a selling advantage. Many investors view tenant-occupied properties as “turnkey investments” because they provide immediate rental income without the hassle of finding new tenants.

I’m HJ Matthews, a commercial real estate investor with over 10 years of experience buying apartment buildings. I’ve handled numerous transactions where owners needed to sell apartment building with tenant situations, and I’ve seen how smooth these deals can be with proper planning.

Understanding the Legal Framework

Here’s something that might surprise you: when you sell apartment building with tenant, the law is actually on everyone’s side. The legal framework protecting both property owners and tenants has been carefully crafted over decades to make these transactions smooth and fair.

The cornerstone principle is simple – leases “run with the land.” Think of it like this: when you buy a house with a swimming pool, the pool comes with it. When you buy an apartment building with leases, those leases come with it too. They don’t vanish into thin air just because ownership changed hands.

This legal concept, called “lease survival,” creates a seamless transition that protects everyone involved. Your tenants get to stay in their homes, and the new owner gets immediate rental income.

State & Federal Rules That Follow the Deed

The beauty of lease survival is that it happens automatically. You don’t need special paperwork or complicated legal maneuvers. When the deed transfers, the leases transfer right along with it.

Here’s what this means in practical terms: existing lease terms remain completely unchanged until their natural expiration date. The new owner can’t suddenly decide to evict tenants just because they want to redecorate or because they don’t like the current rent amounts.

Federal law adds an extra layer of protection through the Protecting Tenants at Foreclosure Act of 2009. Even in foreclosure situations, new owners must provide at least 90 days’ notice before terminating any tenancy. This prevents the unfortunate scenario where families get kicked out with just a few days’ notice.

Here in Michigan, where Commercial REI Pros operates, tenant protections are particularly strong. The state requires landlords to provide written notice within 10 days of any ownership change. This isn’t just a courtesy – it’s the law, and it helps maintain trust during the transition.

Tenants keep their fundamental rights throughout the entire process. They can’t be hit with surprise rent increases, they maintain their right to quiet enjoyment of their home, and they keep access to their security deposit funds.

What Happens to Existing Leases and Deposits?

Security deposits often cause the most confusion in occupied building sales, but they’re actually straightforward to handle. The key is treating them like any other asset that transfers with the property.

The new owner becomes the official guardian of all tenant security deposits at closing. This means they’re responsible for returning these funds when tenants move out, assuming the units are left in good condition.

Smart sellers handle deposit transfers through their purchase agreement. Account for all deposits upfront – list each tenant’s deposit amount clearly in your sale documents. This prevents any confusion later and protects both you and the buyer.

Transfer the actual funds at closing through your title company. This creates a clear paper trail and ensures the money goes where it’s supposed to go. Then make sure tenants get notified about their new deposit holder within the required timeframe.

The lease assignment process happens automatically through your purchase agreement. All leases transfer to the buyer unless specifically stated otherwise. This protects tenants from having their housing situation disrupted and gives buyers the income stream they’re purchasing.

The bottom line? The legal framework actually makes selling occupied buildings easier, not harder. Laws protect tenants from displacement while ensuring buyers get exactly what they’re purchasing – a functioning rental property with established income streams.

Can You Sell Apartment Building with Tenant?

Here’s the reality: can you sell apartment building with tenant situations are not only completely legal, but they’re actually the bread and butter of commercial real estate. Most seasoned investors actually prefer buying occupied buildings because they get to see the real numbers from day one.

Think about it from a buyer’s perspective. When they purchase your tenant-occupied building, they’re getting both the property and a proven income stream. No guessing games about whether they can actually rent the units or what the market will bear – the tenants are already there, paying rent, and the cash flow is immediate.

Smart investors love occupied buildings because they eliminate the biggest risk in real estate investing: vacancy. There’s no wondering if they’ll find tenants, no advertising costs, no screening headaches, and no lost rental income while units sit empty.

The key to a successful sale lies in understanding your Net Operating Income (NOI) analysis. When buyers can see exactly what your building generates each month, they can make confident offers and secure financing more easily. Banks love seeing established rent rolls because it proves the property’s income potential.

Can You Sell Apartment Building with Tenant on Fixed-Term Lease?

Can you sell apartment building with tenant on fixed-term leases? This is actually the easiest scenario for everyone involved. Fixed-term leases (usually running 6 months to 3 years) give buyers exactly what they want: predictable, stable income for a known period.

Your most straightforward path is honoring the full lease term. The new owner simply steps into your shoes as landlord, collecting rent according to the existing agreements. This appeals to investors who want steady returns without any immediate drama or complications.

But what if you need more flexibility? Some leases include early termination clauses that allow the landlord to end tenancies after a sale with proper notice. These clauses must be clearly written in the original lease – you can’t just add them later when you decide to sell.

Tenant buyouts offer another route when you need vacant possession. We’ve seen landlords successfully negotiate early lease terminations by offering financial incentives. One recent example involved a landlord who offered tenants their full security deposit plus one month’s rent to vacate 60 days early. The buyer needed vacant units for renovations, and everyone walked away happy.

The beauty of buyouts is that they’re voluntary. You might offer to cover moving expenses, return security deposits early, or provide cash payments equivalent to 1-3 months’ rent. Sometimes helping with new housing deposits sweetens the deal enough to get cooperation.

Can You Sell Apartment Building with Tenant on Month-to-Month?

Can you sell apartment building with tenant arrangements get more interesting with month-to-month tenancies. These give you maximum flexibility, but they require careful timing and proper notice procedures.

Month-to-month tenants can be given notice to vacate – typically 30 days in most states, though Michigan requires 30 days for tenancies under one year and up to 60 days for longer arrangements. This flexibility lets you time your sale strategically.

Cash-for-keys programs work particularly well with month-to-month tenants. We’ve found that offering 2-4 weeks of rent plus moving expenses often motivates tenants to cooperate with your sale timeline. It’s cheaper than dealing with extended vacancy periods, and tenants appreciate the financial cushion for their move.

You can also time the sale to close after tenants have vacated following proper notice. This gives you the option to market the property either occupied or vacant, depending on what buyers in your area prefer.

Some landlords get creative by converting month-to-month tenancies to fixed-term leases before selling. This provides buyers with more predictable income streams, which can actually increase your sale price. A one-year lease gives buyers certainty about their cash flow, making your property more attractive than similar buildings with uncertain tenancy situations.

The key is understanding what your local buyer pool wants. Some investors prefer the flexibility of month-to-month arrangements, while others want the security of longer-term leases. Knowing your market helps you make the right strategic decisions.

Preparing the Property & Partnering with Tenants

When you can you sell apartment building with tenant situations, your success hinges on one crucial factor: treating your tenants as partners, not obstacles. I’ve seen deals fall apart because landlords approached tenants with an adversarial mindset, and I’ve watched smooth transactions unfold when everyone worked together.

Think about it from your tenant’s perspective. They’re probably worried about rent increases, being forced to move, or dealing with a difficult new landlord. Clear communication from day one eliminates most of these fears and creates cooperation instead of resistance.

Start with a simple conversation or letter explaining what’s happening. Tell them why you’re selling, your expected timeline, and most importantly, how their lease terms will be protected. When tenants understand that their rights remain intact, they’re much more willing to help with showings and keep the property looking its best.

Maintaining show-ready conditions becomes much easier when tenants feel respected and informed. We’ve found that small gestures make a big difference. One landlord I worked with offered temporary rent discounts during the marketing period, while another provided gift cards for cooperative tenants who kept their units clean for showings.

The key is finding incentives that work for your specific situation. Some tenants respond to cleaning services during the listing period, while others appreciate flexible lease terms or assistance with moving expenses if early termination becomes necessary.

Showing protocols need to balance buyer needs with tenant privacy rights. You want potential buyers to see the property at its best, but tenants have legitimate expectations about their personal space.

Best Practices for Notification & Entry

Written notice isn’t just a legal requirement – it’s the foundation of maintaining good tenant relationships during your sale. Most states require 24-hour advance notice for landlord entry, and Michigan follows this standard. But smart landlords go beyond the minimum requirements.

Multiple communication methods work better than relying on a single notice. Send the required written notice, but also follow up with emails or text messages. This ensures tenants actually receive the information and can plan accordingly.

Specific timeframes eliminate confusion and reduce tenant anxiety. Instead of saying “sometime this week,” provide exact dates and times. “We’ll be showing the apartment Tuesday at 2 PM and Thursday at 10 AM” gives tenants control over their schedules.

Privacy rights remain paramount throughout the sale process. Tenants can’t refuse reasonable access for showings, but they deserve advance notice, reasonable hours, and respect for their belongings. Most successful showings happen between 8 AM and 8 PM, with landlords or agents accompanying all visitors.

Documenting all communications protects everyone involved. Keep records of notices sent, tenant responses, and any scheduling changes. This documentation becomes valuable if disputes arise or if you need to demonstrate good faith efforts to accommodate tenant needs.

Negotiating Early Move-Outs or Lease Modifications

Sometimes buyers prefer vacant possession, making early move-out negotiations necessary. Success depends on fair compensation and understanding what motivates your specific tenants.

Honest conversations work better than high-pressure tactics. Explain the buyer’s needs and timeline, then ask what would make an early move-out work for them. You might be surprised by their flexibility when approached respectfully.

Meaningful financial incentives should cover actual moving costs plus provide genuine benefit to tenants. We’ve seen successful packages that include full security deposit returns, one month’s rent as a moving bonus, and paid moving truck rentals.

Ample notice makes early termination more feasible for tenants. Sixty to ninety days gives them time to find new housing without rushing into poor decisions. Some landlords even assist with new housing searches through referrals or resources.

Attorney review becomes essential when modifying lease terms or negotiating early terminations. Proper documentation protects all parties and ensures compliance with local tenant protection laws.

Marketing and Closing Strategies for Occupied Assets

Marketing occupied apartment buildings requires a different approach than vacant properties. The key is positioning tenant occupancy as a valuable asset rather than a complication.

Investor-focused marketing highlights:

- Proven rental income with actual rent rolls

- Established tenant base reducing vacancy risk

- Immediate cash flow from day one of ownership

- Market-tested rental rates demonstrating income potential

- Operational systems already in place

We prepare comprehensive rent roll packages that include tenant payment histories, lease expiration dates, and unit condition reports. This documentation helps buyers understand the investment’s performance and potential.

ROI calculations become more compelling with occupied properties because buyers can see actual numbers rather than projections. We include:

- Current gross rental income

- Operating expense breakdowns

- Net operating income (NOI) analysis

- Comparable market rental rates

- Potential income growth scenarios

Creative financing options often work well with occupied buildings. Since buyers can see proven income streams, they’re more comfortable with seller financing or lease-option arrangements.

For Michigan apartment buildings, we’ve found that highlighting stable tenant relationships and below-market rents (indicating upside potential) attracts serious investors. More info about selling Michigan buildings

Selling to Investors vs. Owner-Occupants

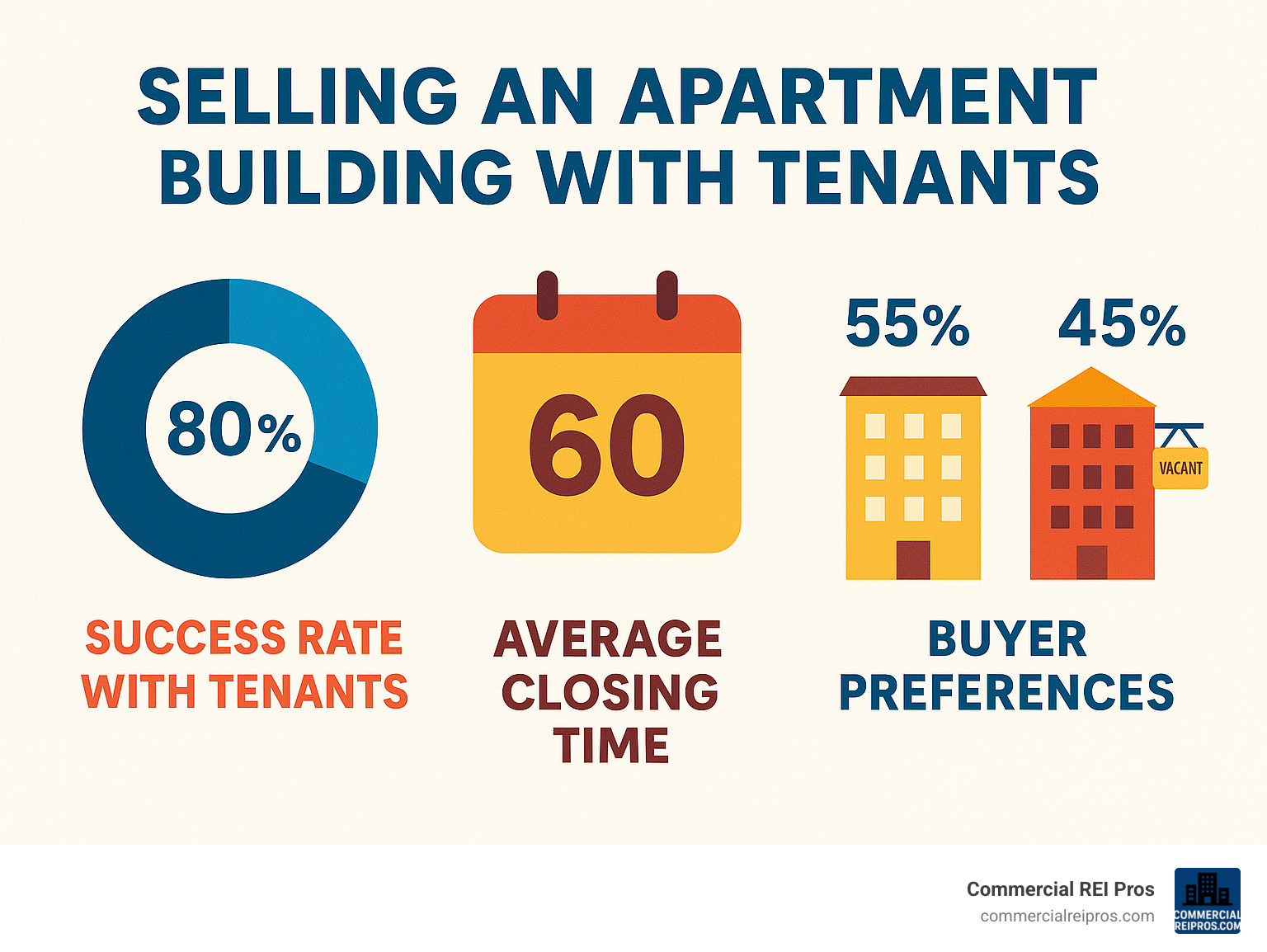

Understanding your buyer pool is crucial for successful sales. Investors and owner-occupants have completely different priorities and concerns.

Investor buyers typically want:

- Properties with tenants in place

- Proven income streams

- Below-market rents with upside potential

- Minimal immediate capital improvements needed

- Strong rental demand in the area

Owner-occupant buyers usually prefer:

- Vacant possession for immediate occupancy

- Properties they can customize to their preferences

- Lower purchase prices reflecting tenant complications

- Flexible closing timelines to coordinate with current housing

Financing constraints differ significantly between these buyer types. Investors often use commercial loans that evaluate properties based on income potential, while owner-occupants typically use residential financing with different qualification criteria.

Due diligence processes vary as well. Investors focus heavily on rent rolls, lease terms, and income potential, while owner-occupants prioritize physical condition and immediate habitability.

Our experience shows that apartment buildings typically sell faster to investors when tenants remain in place, while owner-occupants often prefer to wait for vacant possession or negotiate tenant buyouts.

Handling Showings, Inspections, and Transfer Day

Coordinated access becomes critical during the due diligence period. Buyers need to inspect units, review systems, and understand the property’s condition, all while respecting tenant privacy rights.

Successful showing strategies:

- Schedule block showings to minimize tenant disruption

- Provide advance notice for all inspections and appraisals

- Accompany all visitors to ensure respectful conduct

- Offer tenant incentives for cooperation during busy periods

- Document property conditions before and after showings

Estoppel certificates are essential documents that confirm lease terms, rental amounts, and security deposit balances directly from tenants. These protect buyers from disputes and ensure accurate information.

Transfer day coordination requires careful planning:

- Security deposit transfers through escrow

- Lease assignment documentation

- Tenant notification letters introducing new ownership

- Key and access code transfers

- Utility account transfers where applicable

- Property management transition if applicable

The closing statement should clearly itemize all tenant-related transfers, including prorated rents, security deposits, and any prepaid amounts.

Frequently Asked Questions about Selling with Tenants

Let me address the most common questions property owners ask when they’re considering whether they can sell apartment building with tenant situations. These concerns come up in almost every consultation I have with landlords.

Do I have to honor every current lease after the sale?

This is probably the biggest worry for new buyers, and I understand why. Yes, existing leases are legally binding contracts that automatically transfer to the new owner when you sell. Think of it like buying a car with payments still owed – the debt follows the asset.

The buyer must honor all lease terms, including rent amounts, lease duration, and any special provisions like pet policies or parking arrangements. I’ve seen buyers try to wiggle out of below-market rent agreements, but the law is crystal clear on this point.

There are a few limited exceptions where lease terms might change. If the original lease included early termination clauses, the new owner can use those. Lease violations by tenants that justify termination still apply under new ownership. In foreclosure situations, federal law provides different protections that might override some lease terms.

The most important thing to remember is that the new owner cannot unilaterally change lease terms or evict tenants simply because they purchased the property. This legal protection ensures housing stability for tenants while providing predictable income streams for buyers – which is actually why many investors prefer occupied buildings.

Can the new owner immediately raise rent or evict?

I get this question from both worried tenants and eager buyers. No, the new owner cannot immediately raise rent or evict tenants without proper legal justification. Ownership changes don’t reset the rental relationship.

Rent increases are only allowed at lease renewal time, with proper notice as required by state law (typically 30-90 days), in compliance with local rent control ordinances, or when lease terms specifically allow mid-term increases. In Michigan, we follow standard notice requirements that protect tenants from surprise rent hikes.

Eviction is only permitted for traditional reasons like lease violations, non-payment of rent, property damage, or lease expiration with proper notice. Some jurisdictions allow owner occupancy evictions, but these require following just-cause requirements and proper procedures.

The bottom line is that new ownership doesn’t give landlords special powers to circumvent tenant protections. The same rules that applied to you as the original landlord apply to the buyer. This consistency is actually what makes occupied buildings attractive to serious investors.

What notice is required for tenant showings during the sale?

Here’s where many landlords get nervous about disrupting their tenant relationships. Most states require 24-hour advance notice before entering rental units for showings, and Michigan follows this standard practice.

The notice must be in writing – email, text, or posted notice are typically acceptable. It needs to be specific about timing and purpose of entry, reasonable in frequency (not excessive daily showings), and during reasonable hours, typically 8 AM to 8 PM.

In Michigan specifically, we require 24-hour minimum notice for non-emergency entry, with written notice preferred but not always legally required. The key is maintaining reasonable times and frequency while respecting that tenants cannot unreasonably refuse access.

I always recommend exceeding minimum requirements when possible. Providing 48-72 hours’ notice, offering multiple time options, confirming appointments in advance, and respecting tenant requests for rescheduling goes a long way toward maintaining positive relationships.

Cooperative tenants make sales much smoother. I’ve seen deals where tenants actually helped sell the property by keeping units immaculate and being flexible with showings. A little extra consideration on your part often pays dividends in tenant cooperation.

Conclusion

So, can you sell apartment building with tenant situations? Absolutely, and often more easily than you might think. After helping countless property owners steer these sales, I’ve seen how smooth the process can be when you approach it with the right mindset and preparation.

The secret isn’t complicated – it’s about treating your tenants as partners rather than problems to solve. When you communicate clearly, respect their rights, and plan carefully, occupied building sales often close faster and smoother than vacant properties.

The numbers don’t lie. With 90-95% of commercial real estate transactions involving tenants who stay with the property, you’re actually following the norm rather than taking an unusual path. Investors love these properties because they provide immediate rental income and proven performance records.

Your tenants’ occupancy is actually a selling point. While it might feel like a complication, smart buyers see occupied buildings as turnkey investments. They get immediate cash flow, established rental rates, and working property management systems from day one.

The legal framework protects everyone involved. Leases automatically transfer to new owners, tenant rights remain intact, and security deposits move seamlessly through the closing process. You don’t need to worry about complex legal maneuvers – the system is designed to work.

Communication makes all the difference. Keep your tenants informed about the sale timeline, respect their privacy during showings, and consider small incentives to maintain their cooperation. A $100 gift card for keeping units show-ready often pays for itself in smoother transactions.

Here in Michigan, we’ve handled occupied building sales from Detroit’s busy neighborhoods to Grand Rapids’ growing rental markets. Each transaction reinforced the same lesson: preparation and respect for tenant rights leads to successful outcomes for everyone.

At Commercial REI Pros, we specialize in purchasing apartment buildings directly from owners, including properties with tenants in place. We understand that every occupied building sale has unique circumstances, and we’re experienced in handling tenant communications professionally and respectfully.

Our as-is purchase approach eliminates the typical headaches of traditional sales. No broker fees, no lengthy marketing periods, and no complicated negotiations with multiple parties. We can close quickly while ensuring your tenants are treated fairly throughout the process.

Whether your building has long-term tenants on fixed leases or month-to-month arrangements, we can structure a purchase that works for your situation. We’ve handled everything from fully occupied buildings to properties with mixed occupancy, and we know how to make the process smooth for everyone involved.

If you’re considering selling your tenant-occupied apartment building in Michigan, let’s talk. We’d be happy to discuss your specific situation and explore how our direct purchase approach might work for you. More info about contacting us

Selling with tenants isn’t just possible – it’s often the smartest approach. With proper planning and the right buyer, your occupied building can become someone else’s perfect investment opportunity while providing you with a hassle-free sale experience.