Why Avoiding Broker Fees Saves Commercial Property Owners Thousands

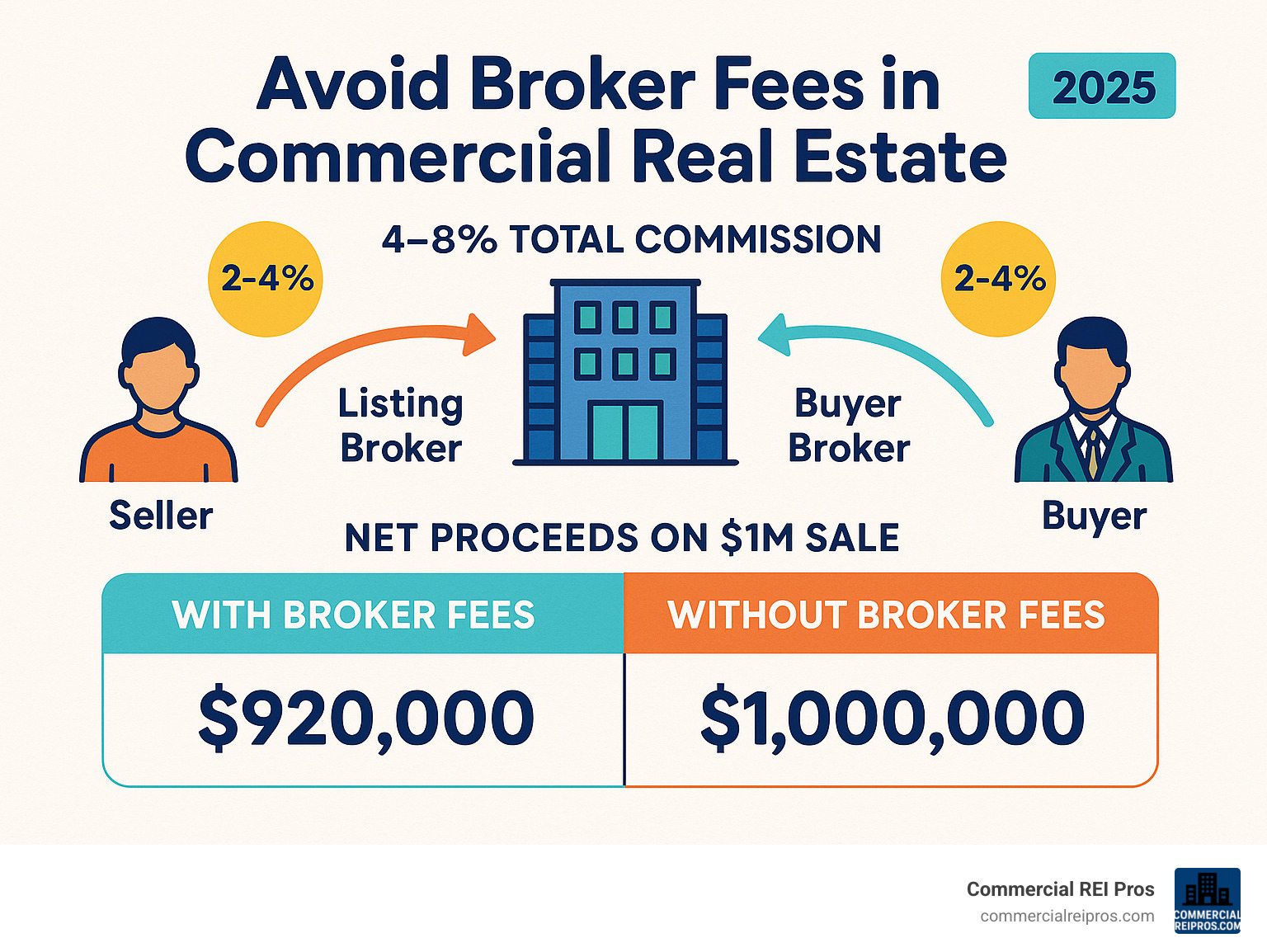

Avoid broker fees commercial real estate transactions and you could save between 4% to 8% of your property’s value – that’s $40,000 to $80,000 on a $1 million property sale. With commercial broker commissions typically ranging from 3% to 7% on leases and 1% to 6% on sales, these fees add up quickly for property owners looking to exit the market.

Quick Ways to Avoid Commercial Broker Fees:

- Direct owner sales – Sell directly to cash buyers or investors

- Off-market deals – Use wholesaler networks and investor meetups

- Large property complexes – Work with on-site leasing teams

- DIY marketing – List on LoopNet, Crexi, and specialized platforms

- Landlord-paid arrangements – Negotiate commission coverage in weak markets

- Timing strategies – Move during off-peak seasons for better leverage

The traditional commercial real estate model puts significant financial pressure on property owners. As one industry expert noted, “Buyers and sellers hold the power in commercial real estate because brokers need the deal.” This leverage becomes especially important for retiring property owners in Michigan who want to avoid the stress of lengthy sales processes and high commission costs.

Many successful property owners are finding that direct sales, off-market transactions, and creative financing can eliminate broker fees entirely while providing faster, more predictable closings.

I’m HJ Matthews, a commercial real estate investor with 10 years of experience helping property owners avoid broker fees commercial real estate through direct sales, off-market deals, and creative financing strategies. My background in digital marketing and commercial investing has shown me how property owners can save thousands by bypassing traditional brokerage models.

What Exactly Are Commercial Broker Fees?

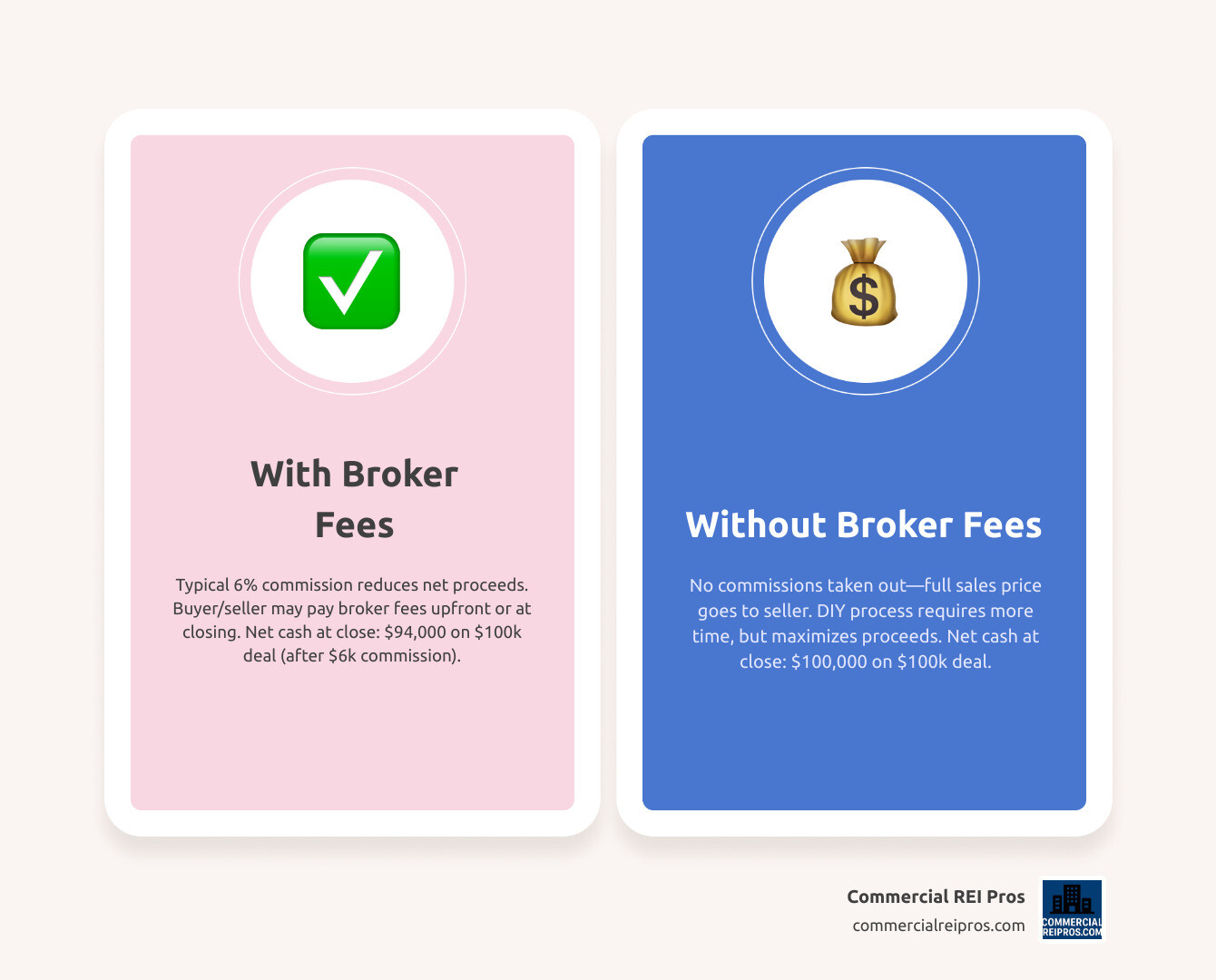

Commercial broker fees are the commissions paid to real estate agents who help facilitate property transactions. Think of them as the middleman’s cut for bringing buyers and sellers together. Unlike residential real estate where you might see a standard 6% commission, commercial rates are all over the map.

The wide range exists because commercial deals vary dramatically. A small office building sale looks nothing like a massive industrial complex lease, and the commission structure reflects that complexity.

Here’s what you’re typically looking at:

Sales transactions usually run 4-8% of the purchase price, though high-value properties might see rates as low as 1%. Leasing deals typically cost 3-7% of the total lease value. Property management fees hover around 3-10% of monthly gross rent.

The commission gets split between the listing broker (who represents the seller or landlord) and the buyer’s broker (who represents the purchaser or tenant). In dual agency situations, one broker wears both hats and might reduce the total commission while keeping a bigger slice of the pie.

Market conditions play a huge role in these rates. During tough economic times, brokers often slash their rates to compete for limited business. When properties are flying off the market, rates might creep higher.

| Commission Comparison | 4% Rate | 8% Rate |

|---|---|---|

| $1M Property Sale | $40,000 | $80,000 |

| $5M Property Sale | $200,000 | $400,000 |

| Total Cost Difference | – | +$160,000 |

How Commissions Are Calculated

Commercial commissions work differently depending on whether you’re buying, selling, or leasing.

For property sales, it’s straightforward math. Take a $5 million building with a 4% commission – that’s $200,000 in total fees, usually split 50/50 between the listing and buyer’s brokers.

Leasing gets trickier because brokers calculate their cut on the entire lease term. Let’s say you’re leasing space for $10,000 per month on a 5-year lease. That’s $600,000 in total rent. With a 5% commission, you’re looking at $30,000 in broker fees.

Some brokers offer flat-rate pricing, especially for expensive properties or repeat clients. This can save serious money on high-value transactions where percentage-based fees would be astronomical.

Tiered structures are becoming more common too. As property values climb, commission rates often drop. A $50 million property might only see a 1% rate, while smaller deals in tight markets could hit 6%.

Who Usually Pays?

The short answer? It depends on leverage and market conditions.

In sales transactions, sellers almost always foot the bill. The commission gets deducted from sale proceeds at closing, so buyers rarely pay broker fees directly. This is one reason why property owners looking to avoid broker fees commercial real estate transactions often explore direct sales.

Leasing is where things get interesting. Landlords typically pay leasing commissions, but tenants might get stuck with the bill in hot markets or premium locations. New construction projects often include landlord-paid broker fees as a sweetener to attract tenants.

Market inducements can flip the script entirely. During weak market conditions, landlords might offer to cover tenant broker fees just to fill empty spaces faster. Smart property owners use this leverage to their advantage.

Are They Negotiable?

Absolutely, and this is where commercial real estate differs dramatically from residential deals.

Your negotiating power depends on market leverage. In competitive markets, brokers might accept lower rates to secure listings. When the economy slows down, commission rates often follow suit as brokers compete for limited business.

Property type matters too. Industrial properties, medical facilities, and specialized buildings might command different rates based on the complexity and expertise required. A straightforward office lease might see standard rates, while a complex industrial deal could justify higher commissions.

Deal size is your biggest weapon. Larger transactions typically see reduced percentage rates. A $10 million sale might command 3% while a $1 million property could see 6%. The absolute dollar amount still works out well for brokers on big deals.

This negotiability is exactly why many Michigan property owners are exploring ways to avoid broker fees commercial real estate entirely through direct sales and creative financing arrangements.

Avoid Broker Fees Commercial Real Estate – Proven Strategies

Successfully avoiding broker fees commercial real estate transactions comes down to knowing where to look and when to act. After helping dozens of Michigan property owners steer direct sales, I’ve seen these strategies save thousands while often providing faster, more flexible deals.

The secret isn’t complicated – it’s about going where the brokers aren’t and building relationships that bypass traditional channels entirely.

DIY Property Hunt to Avoid Broker Fees Commercial Real Estate

Your best opportunities often hide in plain sight. LoopNet remains the go-to platform, but smart searchers filter specifically for “owner listings” to find properties listed directly by owners. Crexi offers similar filtering options, while Craigslist continues to surprise investors with direct owner gems, especially in smaller Michigan markets.

Don’t overlook Facebook Marketplace – it’s becoming increasingly popular for commercial properties as owners seek to avoid listing fees.

The old-fashioned drive-by approach still works wonders. Look for “For Lease” signs with owner phone numbers rather than brokerage contacts, vacant properties with visible owner information, and buildings in transition that haven’t hit the formal market yet.

When going direct, you’ll need to handle your own due diligence. Create checklists for property condition assessment, zoning verification, financial document review, and title searches. It’s extra work upfront, but the savings make it worthwhile.

Direct Negotiation With Landlords to Avoid Broker Fees Commercial Real Estate

Timing makes all the difference in direct negotiations. While spring and summer see peak activity, post-September markets often favor tenants and buyers. Property managers consistently tell us that vacant units or hard-to-rent spaces are prime candidates for landlord-paid fees.

Instead of paying broker fees, negotiate equivalent value through free rent periods, tenant improvement allowances, reduced security deposits, or flexible lease terms. Many landlords prefer these concessions over cash broker payments.

Pay special attention to renewal clauses. You don’t want to successfully avoid broker fees commercial real estate transactions only to get hit with unexpected commissions on lease renewals. Build protection into your initial agreement.

For property owners looking to sell directly, contact us to explore how we can help you avoid broker fees entirely through our direct purchase program.

Leverage Large Complexes & New Builds

On-site leasing teams at large apartment communities and office complexes often replace external brokers entirely. These properties frequently offer no broker fees for tenants, plus move-in specials, streamlined applications, and professional property management.

New construction presents unique opportunities as developers typically cover broker fees to fill buildings quickly. They’ll often sweeten deals with first-month free rent, reduced security deposits, generous tenant improvement allowances, and flexible lease terms.

The key is approaching these properties during their initial lease-up phase when occupancy matters more than maximum rents.

Tap Off-Market & Wholesaler Networks

Building relationships opens doors to deals that never see public markets. Local real estate investment meetings, commercial networking events, and property management company gatherings provide access to off-market opportunities.

Wholesaler relationships can be particularly valuable. These investors put properties under contract and assign them to end buyers for fees often lower than traditional broker commissions. The trade-off usually involves cash purchases, as-is conditions, and quick closings.

Many high-value properties never hit public listings. Property managers, attorneys, and accountants often know about upcoming sales months before they become public. A simple conversation about your buying criteria can put you first in line.

Creative Financing & Cash Buyers

Direct negotiations open up financing possibilities rarely available through traditional brokers. Owner-carry mortgages, lease-option agreements, and contract for deed arrangements become realistic options when you’re dealing directly with motivated sellers.

Subject-to acquisitions – taking over existing mortgage payments – can eliminate down payment requirements, though legal review is essential to understand due-on-sale risks.

Lease-option structures create paths to ownership without traditional financing. Tenants apply rent payments toward eventual purchase through arrangements including fixed purchase prices, monthly rent credits, and non-refundable option fees.

For Michigan property owners interested in direct sales, our office building purchase program provides cash offers within 72 hours, eliminating broker fees and lengthy marketing periods entirely.

Peak vs. Off-Peak Seasons for Maximum Leverage:

- Peak seasons (March-August): High competition, full asking prices

- Off-peak seasons (September-February): Better negotiating power, more concessions

- Year-end (November-December): Motivated sellers, tax considerations

- Post-holiday (January-February): Lowest competition, maximum leverage

Risks, Costs & When a Broker Still Makes Sense

Let’s be honest – trying to avoid broker fees commercial real estate transactions isn’t always sunshine and rainbows. While the savings can be substantial, going solo comes with real risks that could cost you more than those broker fees you’re trying to dodge.

I’ve seen plenty of property owners jump into DIY deals thinking they’ll save a fortune, only to get blindsided by unexpected costs and legal headaches. The truth is, sometimes paying a broker actually makes financial sense.

Hidden or Surprise Charges

Lease renewal complications can bite you years down the road. Even when you successfully negotiate your initial deal without a broker, many agreements include sneaky “tail periods” that give brokers commission rights for years after the original transaction. Imagine thinking you’re free and clear, only to get hit with a commission bill on your lease renewal.

Expansion clause triggers are another gotcha. If your lease includes options to expand your space, these additions might be calculated at full market rates rather than renewal rates. What seemed like a great deal initially can turn expensive when you need more room for your growing business.

Attorney and professional fees add up quickly without broker guidance. You’ll likely need legal review of contracts, property inspections, appraisals, and title insurance coordination. These costs can easily reach several thousand dollars – sometimes approaching what you’d pay in broker fees anyway.

Time investment costs are often overlooked. Commercial real estate deals require serious time commitment. Between property research, due diligence, negotiations, and paperwork, you might spend dozens of hours that could be better invested in your core business.

Mitigating Legal & Compliance Risks

State licensing requirements vary significantly, and Michigan has specific disclosure rules for real estate transactions. Certain activities might require real estate licensing, so make sure your DIY approach doesn’t accidentally put you on the wrong side of state regulations.

Exclusive agency agreements can trap the unwary. Sometimes just viewing properties or having preliminary discussions creates agency relationships that trigger commission obligations. It’s like accidentally getting married – you might not realize you’re committed until it’s too late.

Documentation and disclosure requirements are extensive in commercial real estate. Without broker guidance, you’ll need to ensure all required paperwork is properly completed, including environmental assessments, property condition reports, zoning compliance, and ADA accessibility requirements. Miss one critical disclosure and you could face legal problems later.

When brokers add real value becomes clear in complex situations. If your property requires specialized market knowledge, involves tricky zoning issues, or you simply lack time for thorough due diligence, a good broker can actually save you money. They’re also invaluable when dealing with unique financing structures or multiple competing offers that require skilled negotiation.

The key is being realistic about your own capabilities and the complexity of your specific situation. Sometimes the smartest way to avoid broker fees commercial real estate headaches is to work with a direct buyer like Commercial REI Pros, where you get the expertise without the traditional commission structure.

Negotiation & Contract Guardrails

When you’re working to avoid broker fees commercial real estate transactions, smart contract negotiation becomes your best protection. We’ve helped dozens of Michigan property owners steer these waters successfully, and the right approach can save you thousands while keeping you legally protected.

The key is understanding that even when you think you’ve eliminated broker involvement, poorly written contracts can still create commission obligations. That’s why we always recommend having an experienced attorney review any agreement before signing.

Sample Script: Asking Landlord to Pay

Starting the conversation right sets the tone for everything that follows. Here’s an approach that has worked well for our clients:

“I’m a qualified tenant ready to move quickly on the right space. Given current vacancy rates in this market and the seasonal slowdown, I’m hoping you’d consider covering the broker fee in exchange for a faster lease execution and longer-term commitment.”

The beauty of this approach is that it positions you as a solution to their problem rather than just another cost. Most landlords understand that covering broker fees is cheaper than months of vacancy.

Market leverage becomes especially powerful during off-peak seasons. After September, when leasing activity typically slows, landlords become much more willing to absorb costs that seemed non-negotiable during spring and summer rush periods.

Your financial strength matters too. When you can demonstrate pre-approved financing, solid references, and quick decision-making ability, landlords see you as a low-risk tenant worth investing in. We’ve seen property owners accept lower net rents when they know they’re getting a reliable, long-term tenant.

Timing your approach around the landlord’s needs often works better than focusing solely on your own. If a property has been vacant for months, or if the landlord needs to fill space before year-end for financial reasons, they’re much more likely to negotiate favorable terms.

Clauses to Watch in Lease/Sale Contracts

Even the most careful negotiations can go wrong if the contract language creates unexpected obligations. Here are the critical areas that trip up most people trying to avoid broker fees:

Broker of record language should be crystal clear about whether any broker is involved. Vague language like “parties acknowledge potential broker involvement” can create commission obligations even when no broker actually participated in the deal.

Tail periods are particularly dangerous because they can extend broker protection for months or even years after you thought the relationship ended. If any broker language exists in your contract, make sure it’s limited to specific timeframes (typically 30-180 days) and only covers prospects that were actually introduced during the listing period.

Procuring cause limitations protect you from commission claims unless the broker was truly the “procuring cause” – meaning they directly introduced the parties and facilitated the deal. Without this language, brokers might claim commissions on deals they barely touched.

Renewal and expansion carve-outs are essential for lease agreements. Many tenants successfully avoid initial broker fees only to get hit with unexpected commissions when they renew or expand their space. Make sure your lease clearly states that renewal options and expansion rights don’t trigger additional broker fees unless you specifically request new broker services.

Affiliate protections become important if you have multiple business entities. Include language covering tenant affiliates, subsidiaries, and related entities to prevent commission claims on future related transactions.

The experienced team at Merrill & McGeary has seen how proper contract language can make or break fee avoidance strategies. Their expertise in commercial real estate law helps ensure your agreements actually protect you rather than creating new obligations.

For property owners looking to sell directly and eliminate all broker complications, contact us to explore broker-free options. Our direct purchase program removes all the contract complexity while providing fast, reliable closings without any commission obligations.

Frequently Asked Questions about Avoiding Broker Fees

Property owners often have similar questions when considering whether to avoid broker fees commercial real estate transactions. Here are the most common concerns we hear from Michigan property owners:

What’s a reasonable commission to start negotiations?

The beauty of commercial real estate is that everything is negotiable – unlike residential deals where rates feel set in stone. Most commercial transactions see commissions between 4-8% for sales and 3-7% for leases, but these are just starting points.

Your negotiating position depends heavily on your local market conditions. In slower markets or with hard-to-move properties, brokers often accept lower rates to secure listings. We’ve seen successful negotiations start at 2-3% for high-value properties and work up from there.

Property type matters too. A straightforward office building sale might command different rates than a specialized medical facility that requires niche expertise. The key is researching what similar properties in your area have actually sold for, not just what brokers initially quote.

Can I split a reduced commission with my broker?

This gets into some interesting creative territory, but you need to be careful about your state’s rebate regulations. Michigan has specific rules about how commission arrangements can be structured.

Some arrangements that work well include flat fee structures instead of percentages – especially helpful for expensive properties where percentage-based fees become enormous. We’ve also seen tiered commission rates where the percentage decreases as the sale price increases.

Performance bonuses for quick sales can align everyone’s interests. Instead of paying a high upfront commission, you might offer a lower base rate plus bonuses for closing within specific timeframes.

The most important thing is getting everything in writing before you start. Handshake deals and verbal agreements cause more problems than they solve in commercial real estate.

Are broker lien rights enforceable in Michigan?

Unfortunately, yes – Michigan law does allow brokers to claim liens for unpaid commissions, but only when they follow proper legal procedures. This is one reason why avoiding broker relationships entirely can be simpler than trying to negotiate reduced fees.

For a broker lien to be valid in Michigan, they need written brokerage agreements that clearly establish the relationship. They also must follow proper lien filing procedures and prove they were the “procuring cause” of the transaction.

The good news is that proper documentation protects you. If you’re working with a broker, make sure any agreements clearly define scope, duration, and termination conditions. Vague language creates problems later.

This is exactly why many Michigan property owners choose direct sales instead. When you sell directly to investors like Commercial REI Pros, there’s no broker relationship to worry about – no commissions, no liens, no complications. Just a straightforward transaction between buyer and seller.

Conclusion

Avoid broker fees commercial real estate transactions and you could be looking at savings of $40,000 to $80,000 on a $1 million property. That’s real money that stays in your pocket instead of going to commissions.

The strategies we’ve covered aren’t just theoretical – they’re proven approaches that savvy property owners use every day. Commercial broker fees are highly negotiable, unlike those rigid residential rates. Direct owner negotiations often give you better terms than working through brokers who may have their own agenda.

Off-market transactions can be your secret weapon. They eliminate fees while providing faster closings and less hassle. No more dealing with endless showings or waiting for buyer financing to fall through. Creative financing options like seller financing or lease-option agreements open doors that traditional sales can’t.

The key is knowing when direct sales make the most sense. If you need to close quickly within 30-60 days, want to avoid lengthy marketing periods, or you’re dealing with unique circumstances like estate sales or business closures, going direct often beats the traditional route.

Here in Michigan, we’ve seen property owners from Bloomfield Hills to Ann Arbor successfully avoid broker fees commercial real estate through direct sales. They keep more of their sale proceeds while avoiding the stress and uncertainty of traditional real estate transactions.

At Commercial REI Pros, we specialize in helping Michigan property owners skip the broker fees entirely. Our cash buying program eliminates broker commissions (saving you that 4-8% of sale price), lengthy marketing periods, and uncertain closing timelines. We buy properties as-is, so you don’t need to worry about repairs or improvements.

Whether you’re retiring, relocating, or simply want to liquidate commercial real estate quickly, contact us to explore broker-free options for your Michigan commercial property. We provide cash offers within 72 hours and can close on your timeline, not ours.

The commercial real estate market keeps evolving, with more property owners finding the benefits of direct transactions. By understanding your options and negotiating strategically, you can successfully avoid broker fees commercial real estate while achieving your investment and business goals. Sometimes the best deals happen when you cut out the middleman entirely.