Your Guide to Selling Michigan Office Properties

How to Sell Office Buildings in Michigan: A Step-by-Step Guide

Step 1: Assess the Market and Your Property’s Position

Understanding your property’s position in today’s Michigan commercial real estate market is the foundation of a successful sale. The office market has experienced significant shifts, with economic incentives becoming available for repositioning and redevelopment projects as older assets face diminished economic viability.

Current Market Conditions

Michigan’s office market varies significantly by location. Detroit continues to see major transactions, while suburban markets like Southfield, Troy, and Ann Arbor maintain steady demand. According to recent market data, properties are being evaluated based on multiple factors including proximity to major freeway arteries and ongoing large-scale mixed-use developments.

Key Factors Affecting Your Property Value:

- Location and Accessibility – Properties with easy access to I-69, I-96, and I-496 command premium pricing

- Building Class – Class A properties in prime locations maintain strongest values

- Tenant Quality – Fully occupied buildings with quality tenants see higher cap rates

- Age and Condition – Buildings from the 1960s-1980s may require significant repositioning

- Market Comparables – Recent sales in your area directly impact valuation

For example, recent market activity shows office buildings ranging from 1,542 square feet to over 168,000 square feet, with cap rates varying from 6.5% to 13% depending on location and tenant quality. Properties built in the 1960s through 1980s often face the greatest challenges in today’s market.

Essential Documentation to Prepare:

- Current rent roll with lease expiration dates

- Three years of profit and loss statements

- Property tax records

- Environmental reports (if available)

- Recent property inspections

- Capital expenditure history

The high-profile sale example of One Detroit Center demonstrates how even premium properties face unique challenges, with the 957,000-square-foot building being marketed at approximately $104.49 per square foot.

Step 2: Choose Your Sales Strategy with Commercial REI Pros

When it comes to selling your Michigan office building, you have two primary paths: the traditional route involving brokers and lengthy marketing processes, or a direct sale to Commercial REI Pros.

Traditional Sales Process Challenges:

Based on industry data, traditional sales often involve marketing costs, costly repairs and renovations, lengthy inspections and appraisals, multiple property viewings, waiting for buyer mortgage approval, agent commissions ranging from 3-6%, and extended waiting periods that can stretch 6-12 months or longer.

Direct Sale Advantages with Commercial REI Pros:

We’ve streamlined the process to eliminate common pain points that office building owners face. Here’s how our approach differs:

| Factor | Traditional Sale | Commercial REI Pros Direct Sale |

|---|---|---|

| Timeline | 6-12+ months | 30 days or less |

| Commissions | 3-6% of sale price | $0 – No fees |

| Repairs Needed | Often required | As-is purchase |

| Closing Certainty | Depends on buyer financing | Cash offer guaranteed |

| Showings | Multiple disruptions | Single property visit |

Common Motivations for Direct Sales:

Our experience working throughout Michigan – from Detroit to Grand Rapids, and suburbs like Southfield, Troy, and Ann Arbor – has shown us that property owners choose direct sales for various reasons:

- Retirement Planning – Simplifying portfolios and accessing cash quickly

- Financial Challenges – Behind on mortgage payments or facing foreclosure

- Property Condition – Avoiding costly repairs or renovations

- Tenant Issues – Dealing with difficult tenants or high vacancy

- Market Timing – Taking advantage of current market conditions

- Investment Pivoting – Moving capital to other opportunities

We understand that most companies start their search for commercial property online, which is why we’ve made our Commercial Property Cash Offer process completely transparent and efficient.

Our Direct Purchase Process:

- Initial Contact – Submit basic property information

- Property Evaluation – We schedule a convenient walkthrough

- Cash Offer – Receive offer within 72 hours

- Contract Signing – Simple purchase agreement

- Closing – Complete transaction on your timeline

This approach has helped hundreds of Michigan property owners avoid the stress, expenses, and uncertainty of traditional sales while achieving their financial goals.

Financials and Finalizing Your Sale

Understanding the Costs to Sell Office Buildings Michigan

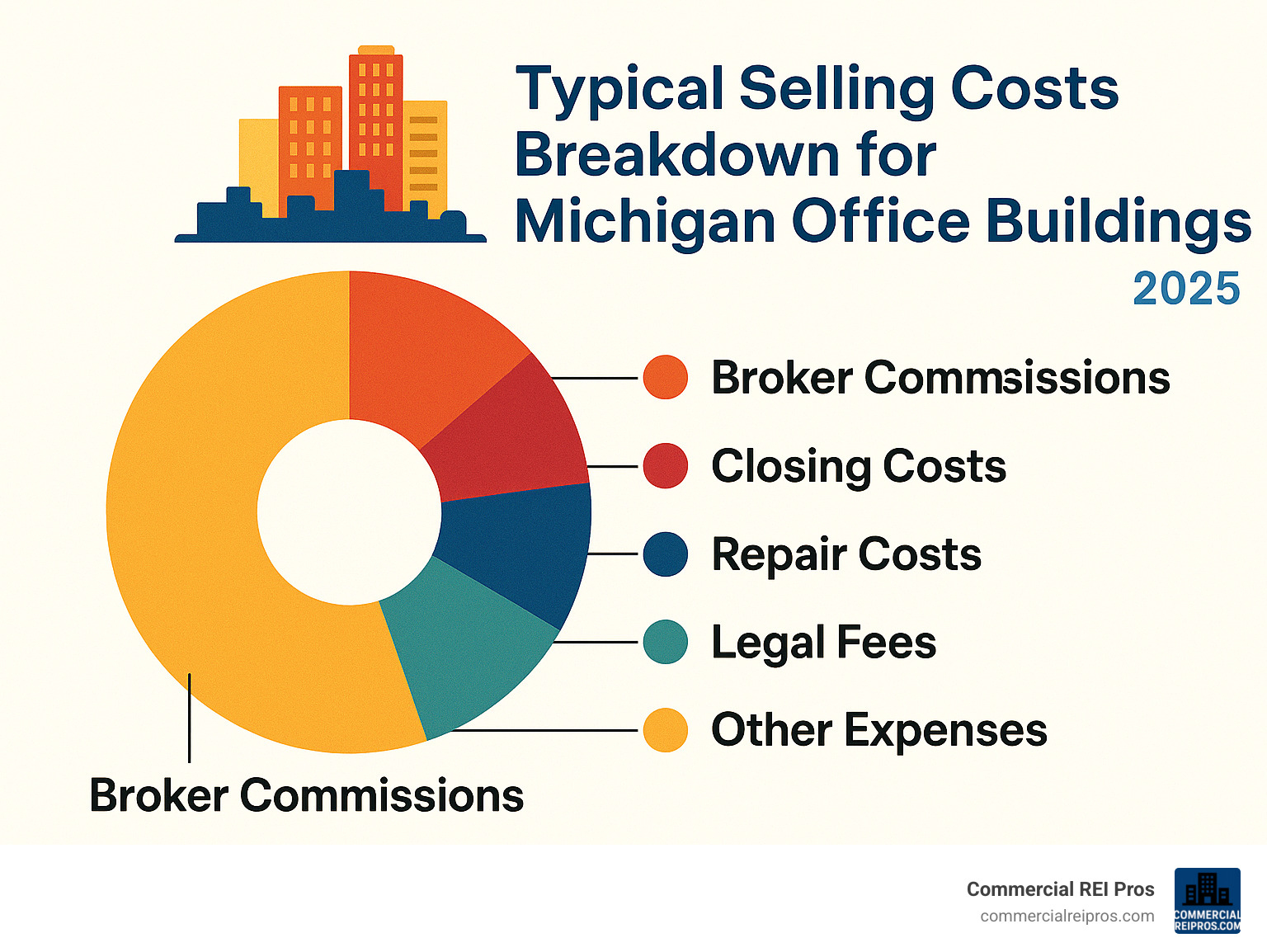

When you’re ready to sell office buildings Michigan, understanding the true cost of your transaction is crucial for making smart financial decisions. Many property owners are surprised to find that traditional sales can eat up 8-12% or more of their sale price in various fees and expenses.

The Reality of Traditional Selling Costs

The biggest expense most sellers face is broker commissions, which typically range from 3-6% of your sale price. On a $1 million property, that’s $30,000 to $60,000 right off the top. But that’s just the beginning.

Closing costs usually add another $2,000-$5,000 to your bill, while title insurance can cost $1,000-$3,000 depending on your property’s value. If you need legal representation, attorney fees often range from $1,500-$5,000 for commercial transactions.

Then there are the inspection-related costs. Property inspections typically cost $500-$2,000, but environmental reports can be much more expensive – sometimes $2,000-$10,000 or more if detailed studies are required. And don’t forget about repair credits that buyers often negotiate based on inspection findings.

Michigan’s Transfer Tax

Michigan adds its own cost with a real estate transfer tax of $3.75 per $500 of property value, which works out to 0.75% of the sale price. While this is often split between buyer and seller or negotiated as part of the deal terms, it’s another expense to factor into your calculations.

How Direct Sales Change the Math

When you sell office buildings Michigan directly to Commercial REI Pros, the cost structure looks completely different. We eliminate broker commissions entirely, which immediately saves you 3-6% of your sale price. We also cover all standard closing costs, so you don’t have to worry about those unexpected expenses.

Since we purchase properties as-is, there are no repair requirements or costly renovation demands. This streamlined approach also reduces legal and administrative fees significantly.

Here’s what often surprises sellers: even if our purchase price is slightly below market value, you frequently net more money because of the eliminated costs. Plus, you avoid months of carrying costs including property taxes, insurance, utilities, and maintenance while your property sits on the market.

What to Do After You Sell Office Buildings Michigan

Successfully completing your sale is an exciting milestone, but what you do next with those proceeds can make or break your long-term financial success. Many Michigan property owners find themselves with a substantial sum of money and important decisions to make.

Smart Reinvestment Strategies

Property owners across Michigan use their sale proceeds in different ways depending on their goals. Some choose to diversify their investments by moving away from real estate entirely, putting money into stocks, bonds, or other financial instruments for more passive income.

Others prefer to upgrade their properties by purchasing newer, better-located commercial real estate that requires less hands-on management. We’ve seen clients consolidate multiple smaller properties into fewer, larger assets to reduce portfolio complexity and simplify their lives.

Geographic diversification is another popular strategy, where sellers invest in different markets or property types to spread risk and capture opportunities in growing areas.

Understanding 1031 Exchanges

If you’re planning to reinvest in similar real estate, a 1031 exchange can help you defer capital gains taxes. This powerful tool requires careful planning though – you must identify replacement property within 45 days and complete the exchange within 180 days.

You’ll also need to work with a qualified intermediary and meet specific IRS requirements. While 1031 exchanges can provide significant tax benefits, they also add complexity and time pressure to your reinvestment decisions.

Tax Planning Essentials

Commercial real estate sales can trigger substantial tax obligations that catch some sellers off guard. Capital gains tax depends on your profit and how long you owned the property, while depreciation recapture taxes you on previously claimed depreciation deductions.

Don’t forget about Michigan’s state income tax and any potential changes to rates. The tax implications of your sale can be complex, so consulting with a qualified tax professional is essential for optimizing your strategy and avoiding costly mistakes.

The Freedom of Simplification

Many of our clients tell us that selling their office building feels like a weight lifted off their shoulders. Managing commercial real estate can be incredibly demanding – dealing with tenant issues, handling maintenance emergencies, and worrying about market conditions.

After selling, property owners often report reduced stress from eliminating tenant management headaches and no more surprise repair bills. They enjoy more predictable income from alternative investments and greater liquidity and flexibility in their financial planning.

For ongoing insights into commercial real estate strategies and market trends, you can explore our More on Commercial Real Estate strategies resource center.

Your Next Move in the Michigan Commercial Market

Michigan’s commercial real estate landscape continues evolving, and having a clear selling strategy has never been more important. Whether you own an aging office building in Detroit’s downtown core, a suburban property in Troy, or a smaller office space in Grand Rapids, understanding your options puts you in control of your financial future.

What We’ve Learned About Successful Sales

After years of helping Michigan property owners, we’ve identified several key factors that separate successful sales from problematic ones. Market timing matters significantly – current conditions favor sellers who can move quickly and decisively rather than those who hesitate.

Property condition impacts value more than many owners realize. Older buildings, especially those built in the 1960s-1980s, often benefit from as-is sales rather than expensive renovation attempts that may not provide adequate returns.

Location continues to drive demand – properties near major highways like I-69, I-96, and I-496, as well as those close to ongoing development projects, maintain stronger values and attract more interest.

Your sales strategy directly affects your net proceeds. Direct sales often yield higher net returns despite potentially lower gross prices because of eliminated fees and faster timelines. And in today’s market, speed can be incredibly valuable – fast closings eliminate carrying costs and protect you from market volatility.

Why We Built Our Business Differently

We created Commercial REI Pros specifically to solve the real challenges Michigan office building owners face every day. Traditional sales processes weren’t designed with busy property owners in mind – they’re complex, expensive, and uncertain.

Our direct purchase approach eliminates the uncertainty, costs, and delays that make traditional sales so stressful. We provide fair, competitive offers based on current market conditions while removing the headaches that come with conventional transactions.

When you work with us, you get as-is purchases with no repair requirements, fast closings in 30 days or less, and no fees or commissions – you keep 100% of the agreed purchase price. We also offer creative financing options when they make sense for your situation, backed by our local market expertise and deep understanding of Michigan commercial real estate.

Your Michigan Office Building Options

We serve property owners throughout Michigan, from the Detroit metropolitan area to Grand Rapids and all points in between. Our team understands the unique challenges facing different regions of the state, from urban revitalization projects to suburban market shifts.

If you’re considering your options for selling, we’ve created several resources to help you make informed decisions. Learn about alternative structuring options through our Creative Financing Commercial Real Estate guide, or check if we serve your area by visiting See which Michigan cities we serve.

When you’re ready to explore what your property might be worth, you can Get a no-obligation offer on your Michigan office building with absolutely no pressure to accept.

Making Your Decision

The Michigan office market will keep changing, but property owners who understand their options and act with good information will always be best positioned for success. Whether you ultimately choose a traditional sale or our direct purchase approach, having accurate information and experienced guidance makes all the difference.

There’s no obligation to accept any offer, and exploring your options costs nothing but a little time. In a market where timing and flexibility matter more than ever, understanding what your property is worth and how quickly you could sell provides valuable peace of mind and strategic advantage.

Contact us today to discuss your specific situation and learn how we can help you achieve your goals when you’re ready to sell office buildings Michigan.