Why Direct Commercial Property Buyers Are Your Fast Track to Cash

Direct commercial property buyers are real estate investors who purchase commercial properties directly from owners with cash offers, eliminating the need for brokers, lengthy marketing periods, or buyer financing contingencies. Here’s what you need to know:

Key Benefits:

- Cash offers within 72 hours of property viewing

- Close in 7-30 days vs. months with traditional sales

- Zero broker commissions (typically 6% savings)

- No repair requirements – sold as-is

- Handle liens, code violations, and foreclosures

Best For:

- Retiring property owners seeking quick exit

- Properties with deferred maintenance or tenant issues

- Inherited commercial buildings

- Foreclosure avoidance situations

- Multiple property portfolios

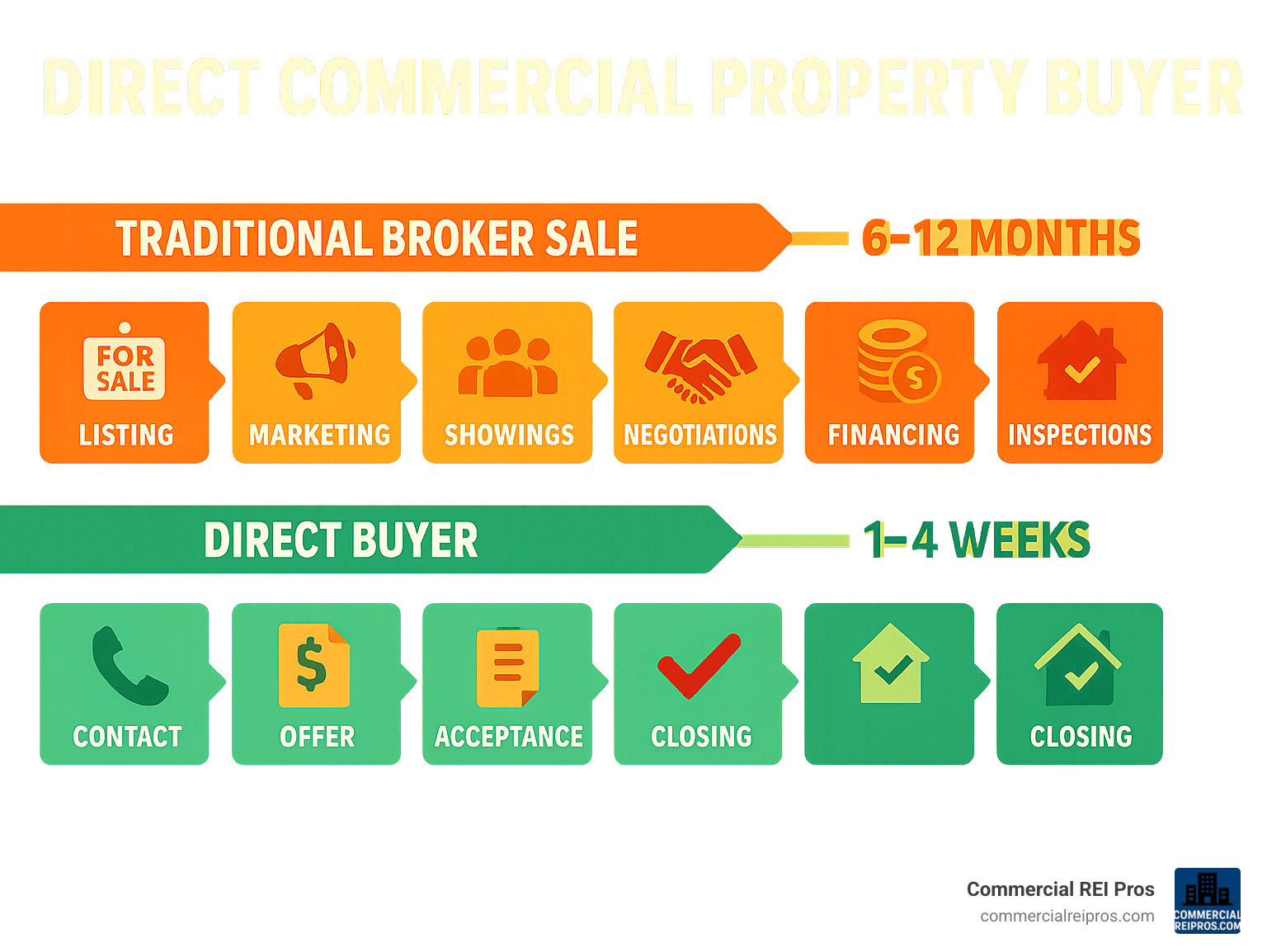

The traditional commercial real estate market can be frustrating. Properties often sit on platforms like LoopNet for months, exposed to 39 million monthly searches but few qualified buyers. Meanwhile, carrying costs, property taxes, and management headaches continue mounting.

Direct buyers offer a different path. They’re typically experienced investors with cash reserves who can close quickly without the complications of traditional sales processes.

I’m HJ Matthews, a commercial real estate investor with over 10 years of experience acquiring undervalued properties and helping owners steer direct commercial property buyers transactions. Through my work at Commercial REI Pros, I’ve seen how direct sales can transform what’s often a stressful, lengthy process into a straightforward, profitable exit strategy.

What Are Direct Commercial Property Buyers?

Direct commercial property buyers are real estate investment companies, like us, or individual investors who purchase commercial properties directly from owners without involving brokers, agents, or listing platforms. Unlike traditional buyers who may need financing approvals and lengthy due diligence periods, direct buyers typically offer all-cash transactions with streamlined processes.

These buyers specialize in acquiring various commercial property types including office buildings, retail spaces, warehouses, multi-family apartments, and industrial facilities. They often purchase properties “as-is,” meaning sellers don’t need to invest in repairs, renovations, or code compliance before the sale.

The business model works because direct buyers are typically experienced investors who understand property values, can quickly assess risk, and have the capital to close fast. They make money by acquiring properties at fair market prices, then either holding them for rental income or improving and repositioning them in the market.

According to JP Morgan’s commercial real estate outlook, current market conditions with higher interest rates have created new opportunities for cash buyers who can move quickly while traditional financing becomes more challenging.

How They Differ From Brokers & Listing Platforms

The differences between direct buyers and traditional brokers are significant:

| Direct Buyers | Traditional Brokers |

|---|---|

| Cash offers within 72 hours | Marketing period of 3-12+ months |

| No commissions (0% cost) | 6% commission typical |

| Private, confidential process | Public listings with multiple showings |

| Guaranteed closing with cash | Financing contingencies and buyer qualification |

| Purchase as-is condition | Often require repairs and improvements |

| Close in 7-30 days | Average 90-365 days to close |

Traditional brokers earn commissions by marketing your property to the widest possible audience, which means public listings, property showings, and extended marketing cycles. While this approach can sometimes achieve higher sale prices, it comes with significant costs and uncertainties.

Direct buyers eliminate the marketing phase entirely. They’re the end buyer, so there’s no need to attract multiple parties or manage showings. This creates a more predictable, faster process but may result in offers slightly below peak market value in exchange for speed and certainty.

Primary Keyword Focus: direct commercial property buyers Explained

Direct commercial property buyers offer three key advantages that traditional sales methods can’t match:

Speed: While traditional commercial sales can take 6-18 months from listing to closing, direct buyers can complete transactions in weeks. We’ve closed deals in as little as 7 days when sellers needed immediate liquidity.

Flexibility: Direct buyers can structure creative deals that work for unique situations. This might include lease-back arrangements where sellers become tenants, partial seller financing, or staggered closing dates to accommodate business transitions.

Creative Financing: Beyond all-cash offers, experienced direct buyers can structure deals with assumption of existing mortgages, seller carryback financing, or even joint venture partnerships where the original owner retains partial ownership.

Why Sell Direct? Key Advantages & Ideal Scenarios

Selling to direct commercial property buyers makes sense in numerous scenarios where traditional sales methods fall short. Here are the most compelling advantages:

No Repair Requirements: Direct buyers purchase properties as-is, meaning you won’t spend months and thousands of dollars on repairs, renovations, or bringing properties up to code. Whether it’s a leaky roof, outdated HVAC systems, or deferred maintenance issues, direct buyers factor these costs into their offers and handle improvements post-closing.

Handle Complex Situations: Properties with liens, tax issues, code violations, or even foreclosure proceedings can still be sold to direct buyers. They have the expertise and resources to steer these complications, often coordinating directly with tax authorities, lien holders, and municipal offices to clear title issues.

Avoid Carrying Costs: Every month your property sits on the market, you’re paying property taxes, insurance, utilities, and potentially management fees. These carrying costs can easily exceed $1,000-$5,000 monthly for commercial properties. Direct sales eliminate this ongoing expense quickly.

Multiple Property Portfolios: If you own several commercial properties, direct buyers can often purchase your entire portfolio in a single transaction, simplifying the process and reducing transaction costs.

When a Direct Sale Makes Sense

Based on our experience at Commercial REI Pros, direct sales are ideal for these situations:

Retirement: When you’re ready to exit the commercial real estate business and want to liquidate assets quickly without the stress of managing lengthy sales processes.

Business Closure: If your business is closing or relocating, you need fast liquidity to handle transition costs and can’t afford to wait months for traditional sales.

Inherited Properties: Heirs often inherit commercial properties they don’t want to manage. Direct sales provide quick liquidity without the learning curve of commercial property management.

Divorce Proceedings: When divorcing couples need to divide assets quickly, direct sales can provide clean, fast resolution without ongoing property management disputes.

Medical Emergencies: Unexpected medical bills or health issues that prevent active property management make direct sales an attractive option.

Upside-Down Mortgages: If your property value has declined below the mortgage balance, direct buyers can sometimes negotiate with lenders for short sales or deed-in-lieu arrangements.

Benefits Recap – Save Time, Save Money

The financial benefits of direct sales are substantial:

- Zero Commissions: Traditional broker commissions of 6% on a $1 million property cost $60,000. Direct sales eliminate this entirely.

- Closing Costs Covered: Many direct buyers cover title insurance, escrow fees, and other closing costs.

- Choose Your Date: You control the closing timeline, allowing you to plan around business needs, tax considerations, or personal circumstances.

- Stress-Free Paperwork: Experienced direct buyers handle most documentation and coordinate with title companies, reducing your administrative burden.

The Direct Sale Process & Timeline

The direct sale process is refreshingly straightforward compared to traditional commercial real estate transactions. Here’s our proven 4-step workflow:

Step 1-2: Initial Consultation & Property Review

Initial Contact: The process begins with a simple phone call, email, or online form submission. We gather basic property information including address, square footage, current use, lease status, and your timeline for selling.

Property Review: Within 24-48 hours, we schedule a property visit. This isn’t a lengthy inspection process – we’re looking at the property’s condition, location, income potential, and any obvious issues that affect value. The visit typically takes 30-60 minutes.

Documentation Gathering: We’ll request basic documents like recent rent rolls, operating statements, tax records, and any existing leases. Don’t worry if you don’t have everything – we can work with whatever information is available.

Step 3-4: Offer, Contract & Closing

Cash Offer: Within 72 hours of our property visit, we present a written cash offer. This includes the purchase price, proposed closing date, and any special terms or conditions.

Contract Execution: If you accept our offer, we execute a purchase agreement and provide earnest money (typically $5,000-$25,000 depending on property value) to demonstrate our commitment.

Title and Closing: We order title work immediately and coordinate with a title company or attorney for closing. Most closings occur within 15-30 days, though we can accommodate faster timelines if needed.

Funding: At closing, funds are wired directly to your account or used to pay off existing mortgages and liens, with the balance going to you.

direct commercial property buyers Process FAQs

What documents do I need? Basic requirements include property deed, recent tax bills, lease agreements (if applicable), and any mortgage information. We can help locate missing documents if needed.

What are my obligations as a seller? Your main obligations are providing accurate property information, allowing property access for inspections, and delivering clear title at closing.

Where does closing occur? Closings typically happen at a title company or attorney’s office convenient to you. In some cases, we can arrange mobile closings at your location.

Valuation, Due Diligence & Payment

Understanding how direct commercial property buyers determine value helps set realistic expectations and ensures you’re getting a fair offer.

How Direct Buyers Calculate Offers

Income Approach: For income-producing properties, we analyze current rent rolls, operating expenses, and net operating income (NOI). We then apply appropriate capitalization rates based on property type, location, and condition. For example, a well-maintained office building might warrant a 7% cap rate, while a property needing significant work might be evaluated at 10-12%.

Market Comparables: We research recent sales of similar properties in your area, adjusting for differences in size, condition, and location. This helps ensure our offers align with current market conditions.

Risk Adjustments: Direct buyers factor in risks that traditional buyers might not accept. This includes tenant vacancy potential, deferred maintenance costs, and market volatility. While this might result in offers slightly below peak market value, it provides certainty and speed.

Future Upside Potential: Experienced buyers can often see value-add opportunities that justify higher offers. This might include lease-up potential, rent increases, or repositioning strategies.

What Due Diligence Looks Like

Title Search: We order comprehensive title searches to identify any liens, easements, or title issues that need resolution before closing.

Lease Audit: For occupied properties, we review all lease agreements, tenant payment histories, and any outstanding tenant issues.

Environmental Assessment: Depending on property type and history, we may order Phase I environmental assessments to identify potential contamination issues.

Survey: We typically order updated surveys to confirm property boundaries and identify any encroachment issues.

Physical Inspection: While we buy as-is, we conduct thorough inspections to understand repair needs and factor these costs into our offers.

Safe & Fast Payment Methods

Escrow Process: All funds are handled through licensed title companies or attorneys, ensuring secure transactions and proper documentation.

Wire Transfers: Closing funds are typically wired directly to your account on closing day, providing immediate access to proceeds.

Mortgage Coordination: If you have existing mortgages, we coordinate payoffs directly with lenders to ensure clean title transfer.

Tax Prorations: We handle all property tax prorations and ensure current taxes are paid through closing.

Mitigating Risks & Verifying Your Buyer

While direct sales offer many advantages, it’s important to verify you’re working with legitimate, qualified buyers.

Red Flags When Selecting direct commercial property buyers

No References: Legitimate direct buyers should provide references from recent transactions, including sellers, attorneys, and title companies they’ve worked with.

Pressure Tactics: Be wary of buyers who pressure you to sign immediately or won’t allow time for attorney review of contracts.

Assignment Clauses: Some less experienced buyers include assignment clauses allowing them to transfer the contract to other parties. This can create uncertainty about who’s actually purchasing your property.

Hidden Fees: Reputable direct buyers are transparent about all costs. Be suspicious of buyers who mention fees or charges not disclosed upfront.

Checklist to Confirm Credibility

Corporate Registration: Verify the buyer is a legitimate business entity registered in your state. This information is typically available through state business registries.

Closing History: Ask for examples of recent closings and contact information for sellers who can provide references.

Proof of Funds: Legitimate buyers should provide proof of funds or financing pre-approval demonstrating their ability to close.

Local Attorney Review: Have your attorney review all contracts and verify the buyer’s legitimacy through professional networks.

Professional Network: Check with local commercial real estate attorneys, title companies, and other professionals who can verify the buyer’s reputation.

Frequently Asked Questions about Direct Sales

What fees or closing costs will I pay?

Most reputable direct commercial property buyers cover all closing costs, including title insurance, escrow fees, and recording costs. You should receive the full offer amount minus any existing mortgages or liens that need to be paid off. Always clarify this upfront and get fee arrangements in writing.

Can I sell with tenants, mortgages, or tax liens in place?

Yes, direct buyers regularly purchase properties with existing tenants, mortgages, and even tax liens. For occupied properties, buyers typically honor existing leases and may even prefer properties with stable tenants. Mortgage payoffs are handled at closing, and many buyers can coordinate with tax authorities to resolve lien issues as part of the transaction.

Will buyers purchase properties needing major repairs or code compliance?

Absolutely. This is one of the key advantages of working with direct commercial property buyers. Whether your property needs a new roof, HVAC system, electrical updates, or has outstanding code violations, experienced buyers factor these costs into their offers and handle all repairs post-closing. You won’t spend a penny on improvements.

Conclusion

Direct commercial property buyers offer a compelling alternative to traditional sales methods, especially when speed, certainty, and convenience are priorities. While you might achieve slightly higher prices through traditional broker listings, the time savings, eliminated commissions, and reduced stress often make direct sales the better choice.

At Commercial REI Pros, we’ve helped hundreds of Michigan property owners transition from “For Sale” to “Sold” through our streamlined direct purchase process. We provide fair cash offers, handle all the paperwork, and let you choose your closing date.

Whether you’re dealing with inherited property, retiring from real estate investing, or simply want to avoid the hassles of traditional sales, direct buyers can provide the fast, professional solution you need.

Ready to explore your options? Contact us today for a no-obligation consultation and find how direct sales can work for your situation. More info about selling your commercial property