Why Selling Commercial Property As Is Can Save You Time and Money

When you sell commercial property as is, you’re choosing to transfer ownership without making repairs, renovations, or improvements to the building. This approach can save months of preparation time and thousands in renovation costs.

Quick Answer: How to Sell Commercial Property As Is

- Legal: Yes, it’s completely legal in all states with proper disclosures

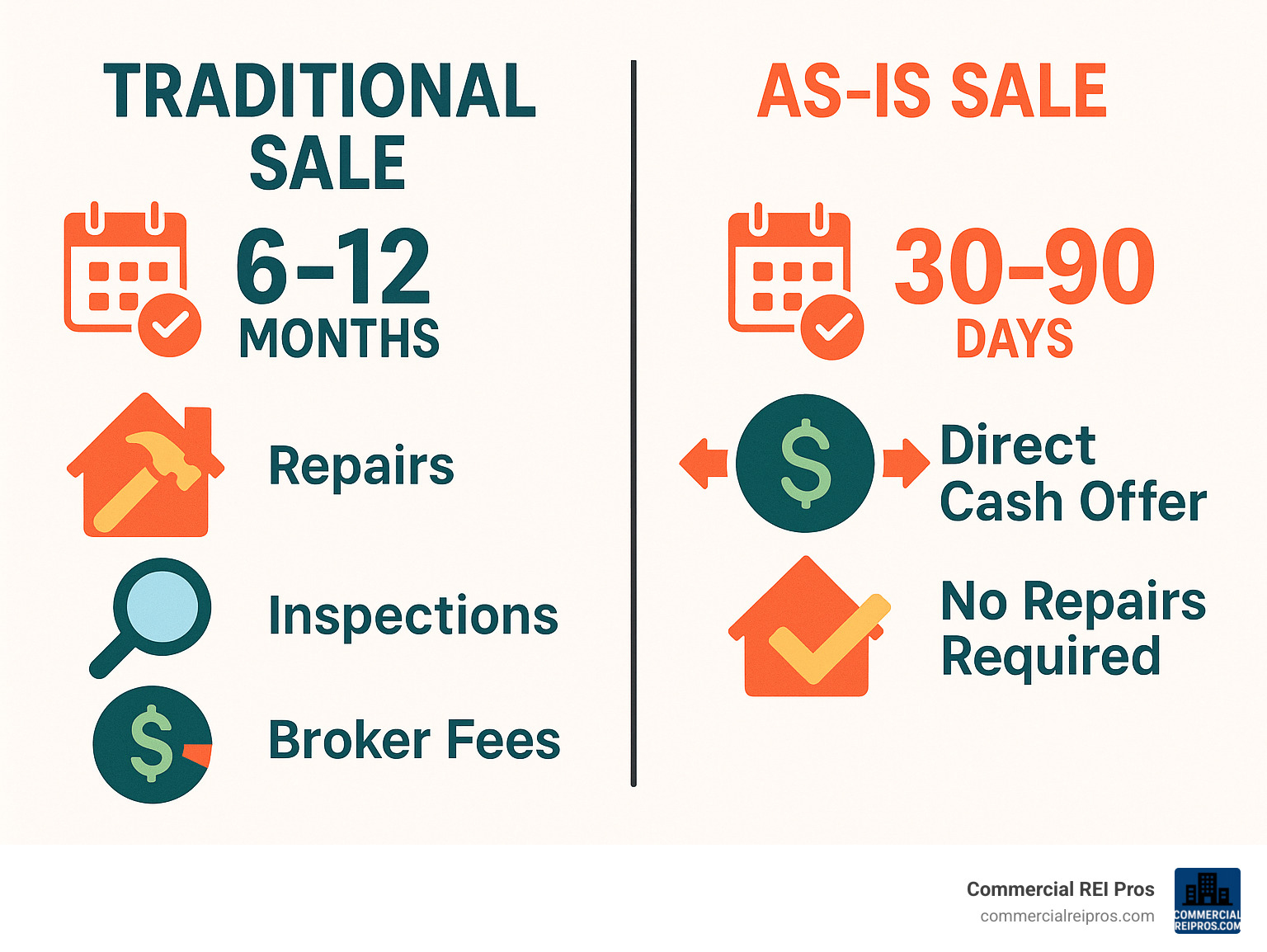

- Timeline: 30-90 days vs 180-360 days for traditional sales

- Requirements: Environmental reports, code violation disclosures, title documentation

- Buyers: Cash investors, real estate companies, fix-and-flip specialists

- Price Impact: Typically 10-20% below market value but saves repair costs and fees

The traditional route of selling commercial real estate can feel like walking a tightrope – balancing tenant concerns, broker demands, lengthy inspections, and costly repairs. Many property owners are finding that selling as-is eliminates these headaches entirely.

Cash buyers can close in as little as 7-30 days compared to the 6-12 month average for traditional broker sales. You avoid the typical 4-8% broker commissions, skip expensive repairs, and eliminate the uncertainty of buyer financing falling through.

This approach works especially well for:

- Properties needing major repairs

- Buildings with code violations

- Inherited commercial real estate

- Owners facing foreclosure or financial pressure

- Anyone wanting a quick, simple transaction

I’m HJ Matthews, and over my 10 years as a commercial real estate investor, I’ve helped dozens of property owners sell commercial property as is when traditional methods weren’t working.

Sell Commercial Property As Is: Meaning, Legality & Property Types

When you sell commercial property as is, you’re essentially saying “what you see is what you get.” This means you’re transferring ownership of your building in its current condition – no repairs, no renovations, no fresh paint to hide problems.

The “as-is” clause in your purchase agreement becomes your legal shield, protecting you from future demands to fix things after closing. The buyers who pursue these deals are typically investors who expect to roll up their sleeves and get to work.

Is It Legal to Sell Commercial Property As Is?

Absolutely! You can legally sell commercial property as is in all 50 states, including Michigan. But legal doesn’t mean “anything goes.”

You still need proper disclosures. In Michigan, if you know about problems that could affect your property’s value or safety, you need to tell potential buyers. We’re talking about structural issues, environmental contamination, code violations, or any legal disputes.

The key word is “known.” You can’t be held responsible for problems you genuinely didn’t know existed. But you cannot hide issues you’re aware of.

Federal regulations also apply, especially regarding environmental hazards. Buildings constructed before 1978 need lead-based paint disclosures. Any environmental contamination you know about must be disclosed upfront.

Proper disclosures actually protect you from future headaches. When buyers purchase your property as-is with full knowledge of its condition, they’re taking on the responsibility to deal with those issues after closing. For detailed guidance on code enforcement requirements, you can reference scientific research on code enforcement standards.

Which Commercial Assets Can Be Sold As Is?

Pretty much any commercial property can be sold as-is. Office buildings are perfect candidates, whether dealing with outdated HVAC systems or worn interiors. Retail properties often move as-is when owners want to avoid buildout expenses.

Industrial and warehouse properties are natural fits since buyers typically plan to reconfigure everything anyway. Multifamily properties needing renovations attract investors who specialize in repositioning assets.

Self-storage facilities, hospitality properties, specialty use properties (churches, schools, medical facilities), raw land, and distressed portfolios all work well for as-is sales.

The key is understanding that as-is buyers aren’t looking for move-in ready properties – they’re looking for opportunities to create value through improvements.

Pros, Cons & Pricing Dynamics of an As-Is Sale

Deciding to sell commercial property as is is like choosing between a quick, straightforward path versus a longer journey with more complications. The biggest advantage? Speed that can’t be matched. While traditional sales drag on for 6-12 months, as-is sales typically wrap up in 30-90 days.

Your wallet will thank you too. Skip the $15,000 HVAC repair, the $25,000 roof work, and surprise electrical issues. When you sell as-is, these become someone else’s project.

Cash buyers bring certainty that traditional financing can’t match. No appraisal surprises, no last-minute loan denials. The as-is approach also limits your liability for future property issues once you’ve made proper disclosures.

Of course, as-is properties typically sell for 10-20% below market value to account for needed work. Your buyer pool shrinks to investors and cash purchasers, and buyers will dig deeper during due diligence.

| Comparison Factor | As-Is Sale | Traditional Sale |

|---|---|---|

| Average Timeline | 30-90 days | 180-360 days |

| Seller Repair Costs | $0 | $15,000-$100,000+ |

| Broker Commissions | Often avoided | 4-8% of sale price |

| Buyer Pool | Investors, cash buyers | All buyer types |

| Sale Price | 80-90% of market value | 95-100% of market value |

| Closing Certainty | High (cash deals) | Lower (financing risk) |

The math often works in your favor despite the discount. A $1 million building needing $75,000 in repairs might net you more money as-is when you factor in avoided broker commissions and carrying costs.

For property owners looking to reach investors directly, Forbes provides valuable guidance on how to advertise availability within commercial real estate properties.

How Selling As Is Impacts Sale Price & Marketability

When you sell commercial property as is, you’re trading a price discount for speed and convenience. The typical discount ranges from 10-20%, but this discount often disappears when you add up avoided costs.

Cap rates work differently with as-is properties. Investors often accept higher cap rates because they see opportunity to add value through improvements. Market timing can work in your favor – during tight lending conditions, cash investors keep moving while traditional buyers struggle with financing.

The key is understanding you’re targeting value-add investors who see opportunity where others see problems.

How to Sell Commercial Property As Is Fast: A Step-by-Step Roadmap

If you want to sell commercial property as is quickly and stress-free, here’s a proven roadmap.

First, start with a property audit. Document your building’s condition – structural issues, old systems, code violations, environmental concerns. Gather lease details, rent rolls, and expense history.

Next, gather all paperwork – deed, title insurance, surveys, tax records, leases, expense statements, and inspection reports. Having these ready makes you look prepared and helps buyers move quickly.

Set a realistic price by looking at similar as-is properties nearby. Get repair quotes if possible. Investors will run numbers based on local cap rates and improvement costs.

Put together a clear disclosure package including all known issues, environmental assessments, code violations, and financial summaries. Transparency builds trust and protects you legally.

Target the right buyers – local investment companies, fix-and-flip specialists, wholesalers, out-of-state investors, or 1031 exchange buyers. Skip the open market if speed is your priority.

As offers come in, negotiate terms. Expect lower initial offers but faster closings and fewer headaches. Be flexible with due diligence requests and creative financing.

During buyer due diligence, make cooperation your secret weapon. Provide inspection access, respond promptly to questions, and help with contractor estimates.

Finally, work with an experienced commercial attorney to close efficiently.

If you’re planning to sell a Michigan office building, Commercial Real Estate Pros can walk you through the process and buy directly – no brokers, no fees, and no repairs needed.

Mandatory Disclosures, Code Violations & Environmental Reports

Even when you sell commercial property as is, you’re still responsible for required disclosures. Any property built before 1978 needs lead-based paint disclosure. Known environmental contamination must be shared. Open code violations – structural, electrical, health department, ADA, or zoning problems – must be disclosed.

Many investors actually prefer properties with clear disclosures and even code violations – they know what they’re taking on and can factor risks into their offers.

A recent Phase I Environmental Site Assessment isn’t required but can be valuable, showing transparency and shortening due diligence.

How Buyers Evaluate & Finance As-Is Properties

Most as-is commercial property buyers are cash investors or use short-term financing like hard money or bridge loans. Traditional banks prefer properties in good condition, so SBA loans generally don’t work if major repairs are needed.

Investors estimate total rehab costs, determine post-improvement value, add carrying costs and profit margins, then back into their offer. This makes your transparency about needed repairs valuable.

Buyers typically want 30-45 days for inspections and detailed financial information. The smoother you make this stage, the faster you close.

Selling As Is to Cash Buyers vs Traditional Financing

Cash buyers can close in 30-90 days, skip appraisals and most contingencies, and worry less about property condition. Sales fall through less often.

Traditional buyers usually need properties up to code for their lenders, meaning more delays and higher deal failure risk.

Selling directly to cash buyers often means skipping broker commissions – that 4-8% savings can offset much of the as-is discount.

Ready to move forward? Reach out to our team at Commercial Real Estate Pros in Southfield, MI for guidance or a quick, no-obligation offer.

Maximizing Value & Avoiding Common Mistakes

Even when you sell commercial property as is, smart strategies can help you maximize returns while avoiding deal-killing pitfalls.

Be Brutally Honest About Everything: Your financial statements should tell the complete story. Include actual rent rolls with lease expiration dates and 2-3 years of operating performance. Investors appreciate honesty because it helps them underwrite deals accurately.

A Little Cleanup Goes a Long Way: You don’t need to renovate, but basic presentation adds value. Simple exterior cleaning, debris removal, and basic landscaping signal responsible ownership. Fix obvious safety hazards and ensure utilities work for inspections.

Target the Right Investors: Focus on qualified investors who buy properties needing work. Local investment groups, property management companies, out-of-state investors, and 1031 exchange intermediaries are good starting points.

Choose Your Sales Strategy Carefully: Direct sales to investors avoid broker commissions but require more marketing effort. Auctions create urgency but may result in lower prices. Traditional brokers provide expertise but charge 4-8% commissions.

Don’t Forget Tax Planning: Consult tax professionals about 1031 exchanges, installment sales, opportunity zone investments, and other tax-advantaged strategies before accepting offers.

For retail properties specifically, our guide on how to sell a Michigan retail building provides additional insights.

Marketing a Commercial Property Being Sold As Is

Marketing as-is properties requires a different approach than traditional sales. You’re selling potential and opportunity, not perfection.

LoopNet remains essential for reaching commercial investors nationwide. Use opportunity language like “value-add potential” rather than focusing on problems. Crexi appeals to tech-savvy investors who move quickly.

Social media marketing can be effective. Facebook investor groups, LinkedIn commercial networks, and Instagram posts with development potential stories generate inquiries.

Direct marketing still works – email blasts to investor databases, direct mail to known buyers, and networking at investor meetings. Property signage emphasizing “investor opportunity” attracts local investors.

Position your property as an opportunity rather than a problem. Instead of “needs work,” try “redevelopment potential with existing cash flow.”

Top Mistakes to Avoid When You Sell Commercial Property As Is

Never hide known problems. Full disclosure builds buyer confidence and helps them underwrite accurately. Hidden defects always backfire when finded.

Price based on reality, not hope. Overpricing scares away qualified buyers. Research actual as-is sales, not listing prices of renovated buildings.

Address obvious safety hazards upfront. Obtain documentation about known violations. Many investors prefer disclosed violations because they can estimate resolution costs.

Verify buyer qualifications with proof of funds before wasting time on unqualified “investors.”

Organize documentation before marketing. Professional investors move quickly on well-documented deals but avoid properties with management problems.

Frequently Asked Questions about Selling Commercial Property As Is

How long does it take to close an as-is commercial sale?

When you sell commercial property as is, most deals close within 30-90 days, compared to 6-12 months for traditional sales.

Cash buyers move fastest since they don’t need bank approval. I’ve seen deals close in 7 days when everything aligned perfectly, though 45-60 days is more realistic for proper due diligence.

Timeline factors include buyer financing type, property complexity, title issues, and your responsiveness to buyer requests.

Can I sell with unresolved code violations or tax liens?

Absolutely – many investors actually prefer properties with disclosed issues. Code violations like minor electrical updates, ADA compliance needs, or permit discrepancies rarely stop sales when properly disclosed.

Tax liens just need to be satisfied at closing from sale proceeds. Even environmental contamination doesn’t automatically kill deals – it attracts specialized investors who understand remediation.

The key is transparency. Disclosed problems attract the right buyers who can budget for fixes.

What documentation do buyers expect for an as-is purchase?

Buyers want comprehensive documentation. Financial records include 2-3 years of operating statements, current rent rolls, tax records, and utility bills.

Physical condition reports cover inspection reports, environmental assessments, structural reports, and code violation notices. Legal documentation includes deed, title policy, current survey, and zoning compliance letters.

Maintenance records showing capital improvements, routine maintenance, warranties, and contractor contacts help buyers understand property care.

Organizing this documentation before marketing shows professionalism and speeds closing.

Conclusion & Next Steps

When you sell commercial property as is, you’re trading maximum sale price for speed, certainty, and peace of mind. This strategy works when you need quick liquidity, want to avoid repair costs, or own a property requiring significant capital investment.

The compelling benefits include closing in 30-90 days, avoiding repair expenses entirely, working with cash buyers who have fewer contingencies, and enjoying a simplified process without broker complications.

Success requires realistic pricing based on as-is comparables, full disclosure about known issues, proper documentation with organized records, and targeted marketing focused on investors.

Consider this approach if you need to close quickly due to financial pressure, own a property requiring expensive repairs, want to avoid disrupting tenants, lack time to manage a traditional sale, or are settling an estate.

Your next steps include assessing your property condition, researching comparable sales, consulting with attorneys and tax advisors, and considering direct buyers who specialize in as-is purchases.

At Commercial Real Estate Pros, we specialize in purchasing commercial properties as-is throughout Michigan. Based in Southfield, we serve property owners from Detroit to Ann Arbor, offering fast closings without broker fees or repair requirements.

Whether you own an office building in Birmingham, retail center in Troy, or industrial property in Warren, we provide no-obligation cash offers within 72 hours. We handle all closing costs, work around your timeline, and purchase properties regardless of condition.

Ready to explore your options? Contact our team for a custom cash offer and find how selling as-is can provide the speed and certainty you need while maximizing your net proceeds.